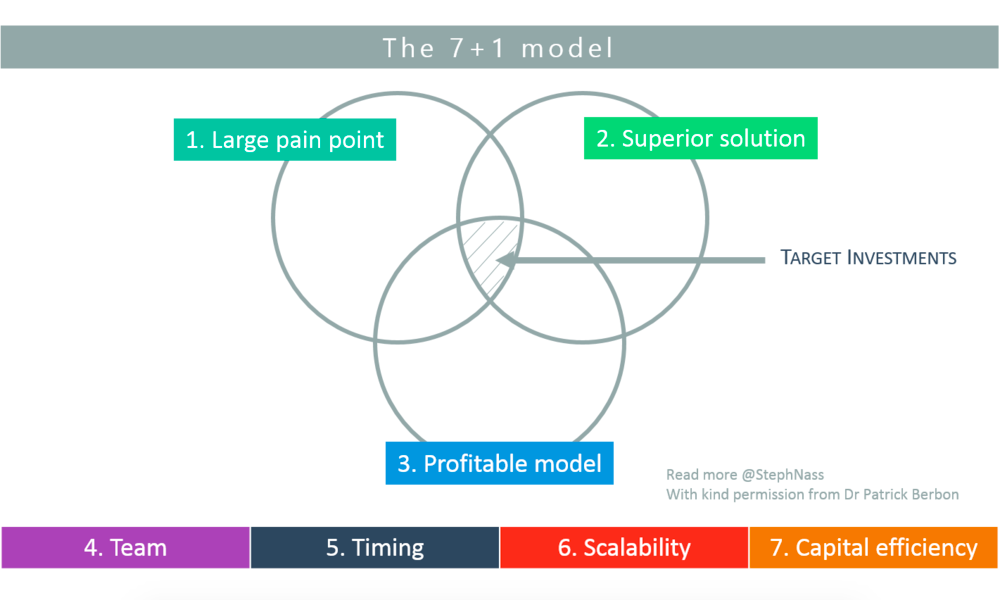

The “7+1 model” was designed by Dr. Patrick Berbon, whose lecture I had the opportunity to attend in Shanghai, during my time at East China Normal University. Dr. Berbon is a serial entrepreneur and venture capitalist currently operating in China. He kindly proofread and agreed this paper be released. Kudos to him.

Table of Contents

Introducing the framework

We are talking about a 7-dimension assessment which lets you identify the most promising start-up projects. The 7 dimensions are:

- Market Pain;

- Solution;

- Business Model;

- Team;

- Timing;

- Scalability;

- and Capital Efficiency.

Before that, let me suggest a few ways to use this framework. The “7+1 model” was originally crafted to assess a venture project. You can also use it as a great layout for a pitch deck: starting from the initial situation with Market Pain, going through all the aspects of the project, and ending on Capital Efficiency. Smooth!

1. A large pain point in the marketplace

Are you addressing a clear pain point? Most of the time, you will address one main point and several secondary ones. You need to make it dramatically clear, what the one value you bring to the market is.

Who are the customers feeling that pain? This means market segmentation. Think “target” and “persona” here. Spend time with your first customers. Listen to them. Don’t trust them.

How painful is the pain point? The more painful, the better. You want to sell painkillers, not vitamins.

Are you addressing a conscious pain ? An unconscious pain means more costs due to market evangelization, and slower penetration. Basically, you will have to teach your customers why they are wrong and need your solution.

How is the pain point addressed today? List all your direct and indirect competitors and assess how you perform against them in every aspect of the solution: cost, performance, speed, etc. It should be a fair match overall, but you must significantly outweigh them in at least one aspect.

Is the addressable market size above 1 billion dollars? If you want to build a huge business, go for huge markets. Under $1bn, don’t expect to get VC-funded.

Is the market growing over 30% a year? It is not just about market size in the long term. A fast-growing market means you arrive early enough in the industry lifecycle. You didn’t miss the tornado. So you still have a chance to become the market leader which, in the end, is all you should care about.

2. A superior solution to the particular pain point

What is your solution? Prioritizing your features is critical, all the more at the beginning since the runway is very short.

Does your solution solve the pain point? Especially for technical entrepreneurs whose project originates from an innovative technology, they need to find relevant applications for it. (However, I tend to think that starting from a pain point is easier than starting from a technology.)

How is your solution 10 times better in at least one dimension than your competitors’? Unless your solution is an order of magnitude better than competition (including statu quo), you won’t overcome resistance to change.

Is your solution beyond proof of concept? What doesn’t work, cannot sell.

Can your solution become the market leader? There is no way to be sure you will be the market leader, but there are sure ways to know you won’t. Just like for billion-dollar businesses, VC investors are looking for future market leaders, not niche projects.

3. A profitable way to apply your solution to the problem

What is your Business Model (BM)? Describe how the project will generate revenue. A start-up is about creating value in the marketplace, not funding creativity.

What is your competitive advantage? Making profit is good, being able to defend your profit is better.

How will you receive monopoly profit? Monopoly is the Graal for every start-up project. Peter Thiel famously told 4 legal ways to reach monopoly: proprietary technology, network effect, economies of scale and branding. Pick one and make sure it’s strong.

What is your Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC)? There are a few key performance indexes you should keep your eyes on. If CLV < CAC, you are in trouble.

How do you reach the customers? There again, 4 main distribution channels co-exist, pick one to begin with: complex sales, direct sales, marketing & advertisement, or viral marketing.

4. A team that can implement the business plan

Who are the founders? A founder is someone who has shares (= dividends + decisions) and an operational role in the organization. Otherwise, it is either an investor or an advisor.

Have they achieved something hard before? When dealing with first-time entrepreneurs, previous experiences are barely relevant to predict entrepreneurial success. The only thing you can assess with certainty is their ability to thrive in front of difficulties and hardship.

Have they achieved something hard together before? Being friends and working 24/7 under pressure are two different things. Team implosion remains one of the top causes of early-stage failure.

Who is on the board of advisors? Adding advisors is the easiest way for a young team to build credibility, and avoid beginners’ mistakes.

Is this really what you want to do? This simple little question is in fact the most important of them all! It eliminates 50% of all first-time entrepreneurs. And if it is missed, it leads to terrible years for the now-funded entrepreneur and his now-investors. This ultimately relates to having alignment between your personal goals/mission in life and your daily activities.

What are the skills of the team? You want a team with complementary expertise: marketing, finance, sales, technical, etc. You also want to match personality types with various functions.

Does the team have an entrepreneurial spirit? Ultimately, having an entrepreneurial spirit means you are willing and happy to do whatever needs to be done!

5. An answer to “Why now ?”

What has changed in the last quarters or years to justify that now is the right time to invest in this project? The strongest and most common answer is that this particular technical solution was not available until now!

Was this business model not applicable before? Chances are, you are not the first to think of this business idea. You need to come up with a good reason why you will be successful where the others failed or chose to opt-out.

6. A business that expands easily and for cheap

Scalability: “ A characteristic of a system that describes its capability to perform under an increased or expanding workload. A system that scales well will be able to maintain or even increase its level of efficiency when tested by larger operational demands.” The direct consequence of scalability is an easier expansion into new geographies and markets.

Is my production scalable? Service is barely scalable, software is very scalable, hardware is somewhere in between, with plateau effects.

Is my marketing scalable? SEA and emailing are potentially infinitely usable, while buzz and guerilla marketing are not.

Is my distribution scalable? If you can deliver your offer anywhere in the world, regardless of regulation, language, culture, distance or local partnerships, then you are very, very lucky!

Is my workforce scalable? Uber is a good example of workforce scalability, as they “outsource” drivers. Youtube is even better: they outsource the content production to their users, and for free.

7. A high return for a low investment

Capital efficiency is the productivity of capital. Basically, you divide the output by the capital involved to produce it. Put it another way, that’s how much money you make for every dollar you invest in a company or a project.

When it comes to fundraising, capital efficiency is key. When a VC or a BA invests in a company, they have a target return in mind. Let’s say 10x. That means if they invest $5M now, they expect to get at least $50M at the exit. In an ideal world, you would require little investment and deliver high exit value. From that point on, it is easy to understand that all companies are not born equal when it comes to cap efficiency. A hardware company won’t be as capital efficient as a software company, so investors will be more willing to put their money in the latter. Your BM also impacts capital efficiency a lot.

What return on capital can an investor expect from your project? Based on comparable projects, you should know what capital efficiency you can offer to your investors. The earlier the stage, the higher the return, to cover for associated uncertainty.

Can you become cash-flow positive with a small amount of money From the investor point of view, it is a lot easier to make a 10x return on capital on a company that has only raised $10m than it is to make a 10x return on capital when a company has raised $100m.

Conclusion

So, here is the magic formula :

The right team and timing to apply profitable, scalable, capital-efficient, superior solutions to large pain points in the market.

Is that all? Of course not.

First, a framework is nothing without proper execution. Many things have been written about implementation over idea. In short, if your project meets all the conditions above, you have a good score. But writing a good score doesn’t mean that you can play music well. Hence the significance of the Team (back to point 4).

Second, this framework is designed for a certain type of business. The framework is designed to build equity business with world-class ambitions and aiming for market leadership. If you just want to start a typical lifestyle business, be your own boss and make a living, keep it simple. Pick the best location you can afford in town and start an F&B business.

Third, this framework should be correctly used. The7+1 framework looks very convenient and it is, provided you are able to correctly answer each question. For example, market size. When Uber started, the taxi industry was not particularly huge or fast-growing. But Uber is not addressing the taxi industry, it is addressing the personal transportation industry as a whole, including cars, public transport and, of course, taxis. Missing the point here would be detrimental to the final conclusion, wether to start/invest in the project or not.