Before contacting investors, you need to build your investor list.

Annoying? Yes. Necessary? Also yes.

For most founders, fundraising is a long journey. A solid investor list helps you map out your funding options and design the optimal access path for every investor.

This post will show you how to build the perfect investor list, step by step.

Table of Contents

What makes the perfect investor list?

1. The perfect investor list is big enough: 100x your round size

Let's assume every investor in your list has a 1% chance to say "yes". If you want to raise $1M, then you should have $100M on the shortlist. If you want to raise $2M, then $200M.

It's simple math, yet most founders don't do it. Big mistake: that's how you end up with shortlists that are too small for your target raise.

But how do you find that "check size" number?

Investors are pretty public about their "sweet spot". You can find it on their websites or just ask them directly. OpenVC also provides you with their minimum and maximum check size, so you know what to aim for.

Ideally though, you don't just want 100x your round size. You want the full picture of the total "capital pool" available to you. How many people are there in the whole world who would be a good fit for investment? Well, you want all of their names on your shortlist before you start raising.

Armed with that number, you will be able to design an effective fundraising strategy. That's why the list should be as comprehensive as possible.

2. The perfect investor list is curated: the 4 golden filters

A comprehensive list isn't a spam list. Actually, it's the opposite.

Investors are hyper-specialists. Make sure that every investor in your list matches all 4 criteria AKA the 4 golden filters:

- Geography: Does the investor invest in your geography? Most investors are legally restricted to invest in a few countries only.

- Verticals: This is a broad term that includes industries, market, customer type, etc.

- Stage: Does the investor do pre-product deals? Pre-revenue deals? Or later?

- Check size: If you're raising $500k, don't waste your time with investors who cut $MM+ checks, they're just not the right fit.

That way, you will focus your resources and efforts on investors who are actually likely to invest.

3. The perfect investor list is realistic: 16 hours of work

Curation matters, but don't overdo it.

I've seen founders do super extensive research on every investor, and collect crazy data points in their list: AUM, fund vintage, last known investments, follow-on strategy, known LPs, etc.

It's cool, but probably not worth your time.

For one thing, the data isn't always accurate, so you don't want to index too hard on it. Besides, I like leaving a bit of space for serendipity. An investor might not tick all your 35 boxes, but still be a valuable meeting, offer great insights, offer an intro, etc.

Don't over-optimize. Just roll with the 4 filters. That's enough.

The 4 steps to build your investor list

Now, let's build the list!

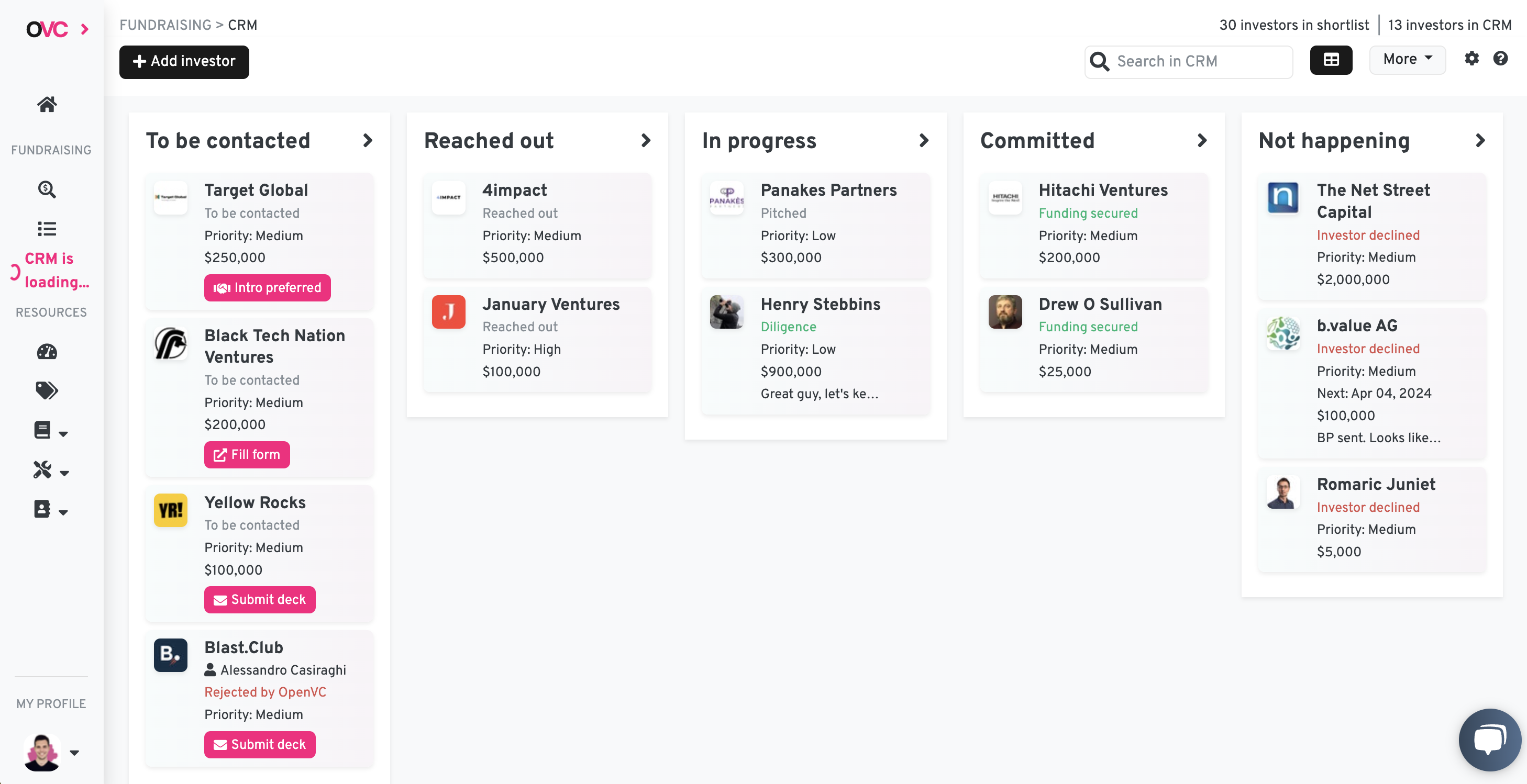

For the following steps, I'll assume you're using OpenVC - it's free. However, the process also works with Google Sheets or any other CRM of your liking.

Step 1: List down your immediate network

If you're raising a smaller round, chances are your immediate network will be your first investors.

List down your mom, your HS friends, your ex-colleagues, and anyone else who likes you enough to cut a $1k+ check. That's how it starts.

If you're using OpenVC, go to OpenVC.app/shortlist, click "Add investor" and add a "non-OpenVC investor".

Rinse and repeat until your whole network is listed.

Step 2: List down investors from the free OpenVC database

Head to OpenVC.app/search, select the right filters, and generate a list of relevant investors.

If you're using the OpenVC CRM, just click "Add to shortlist" and you're done. Otherwise, copy them manually into Google Sheets or your CRM of choice.

Step 3: Expand your search to other investor databases

OpenVC doesn't have 100% of all the investors available - yet. 🙂

So expand your search to other databases.

Go to https://openvc.app/blog /vc-list, this is the largest collection of investor lists on the internet. Some are free, some are paid. Pick the relevant ones and import the data into your own list.

Step 4: Quickly clean up your investor list

At this point, you have a solid shortlist, but it's not fully actionable yet.

Time to clean up the list!

Lock yourself in a room, turn up the music (I recommend the OpenVC playlist ), and fill in the blanks. Not fun, but this is the final push.

At this point we're not going to add email adresses, intro paths, etc. This will come later in the process. For now, all we want to do is:

- Remove potential dupliucates

-

Make sure every investor in the list matches all 4 criteria

- Fix any other quick and obvious data error

My investor list is ready. What's next?

Congrats! Now, you have all the necessary inputs to design your fundraising strategy.

The next step include defining an approach for each investor, identifying the proper channels, enriching the data with the contact info, and finally, executing the raise.

But that's for another post (coming soon)!