Liquidity, or the amount of money circulating in the economy, is shrinking. This was the intent of the Fed and other central banks as they raised interest rates globally and stopped the practice of quantitative easing (QE). QE is when central banks and the Fed buy mortgage-backed securities and treasuries from the banks and other financial institutions so that they have more money to lend out, but it also bloats the central bank’s balance sheet.

The Fed and the other central banks do this to stop inflation from growing and bring it back to an acceptable 2% annually. Less excess money means fewer people can buy goods and services to drive up the price. Less demand leads to less inflation.

When interest rates get raised, the liquidity or available money shrinks because fewer people and companies want to pay higher monthly payments for their loans. The loan is more expensive over time. It tends to depress economic activity and lead to a recession. This is why many experts have said that either we are in the beginning, or already amid a recession. The layoffs from Big Tech are an indication of this.

For example, the Fed overnight lending rate of over 5% is the cost that the bank incurs. To make their money, they have to add to the final rate offered to the borrower. Hence home mortgage loans from the bank now run at around 7-8%. For other types of loans, especially riskier ones, it is higher.

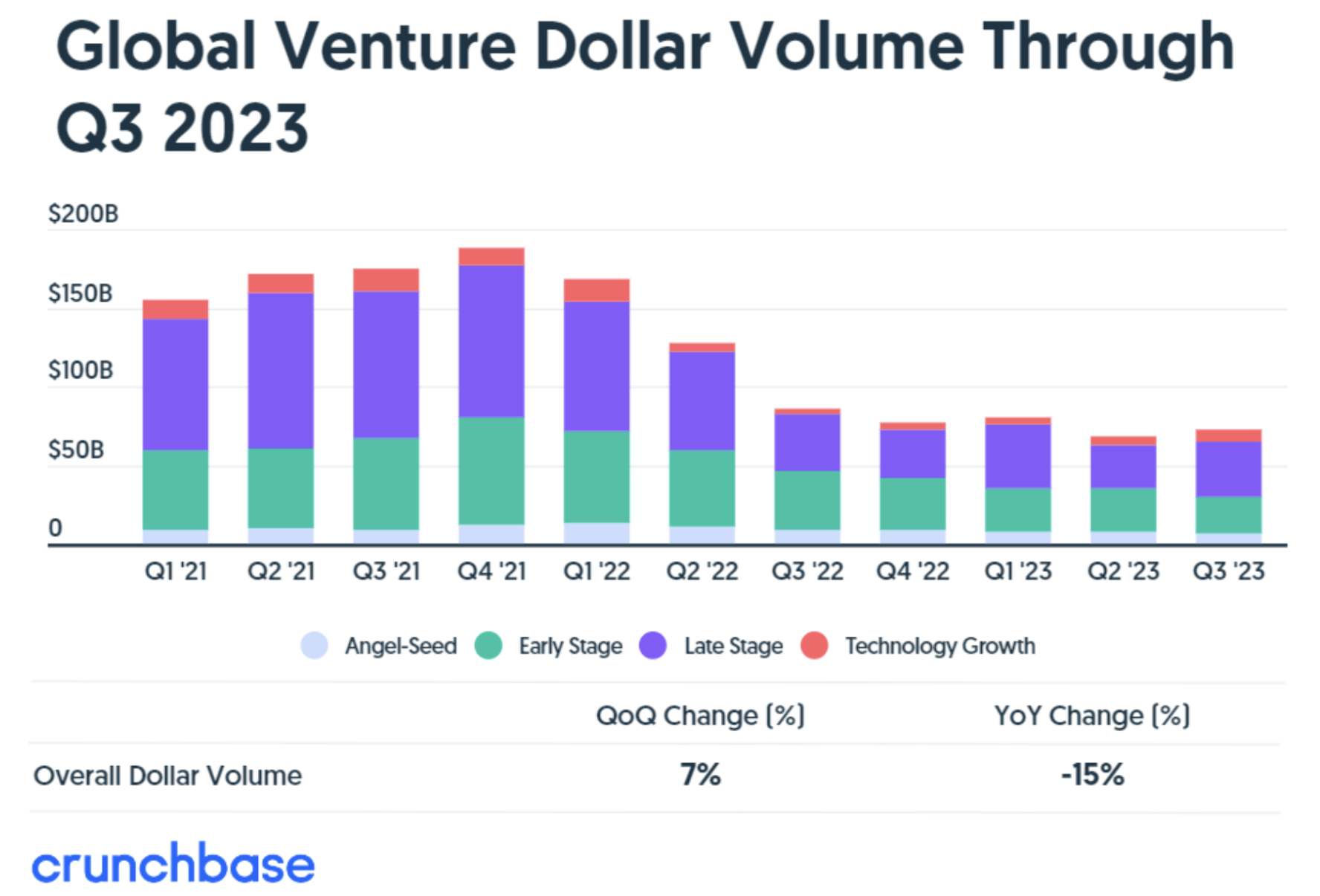

This onset of a stricter monetary climate has partly fueled a global slowdown in venture funding. The downturn of the VC market in 2022 was accelerated this 2023. Data from Crunchbase indicate that we are six quarters into the current funding decline, with Q2 2023 recording the lowest funding numbers in the past two years.

So in this environment that is beyond the control of most small startups, how can you raise funding?

Table of Contents

Step 1: Assess your product

The first order of business is to determine whether your product and service will still be relevant and competitive in a depressed economic environment. Let’s say you are selling luxury goods or high-end items: does your market still exist? Or have they moved to shopping in discount stores and downgraded to eating in fast food chains? If you think that despite the recession or depressed economy, there may still be enough people with disposable cash to buy your product or service, then push forward!

Case in point, they say that if Henry Ford had asked people during his time what they wanted, they would have said “a faster horse.” Not an automobile. But he was clear about what he wanted to do, even if the market didn’t know how to react, and he succeeded in creating a multibillion-dollar industry. The same goes for visionaries like Elon Musk and Steve Jobs. They succeeded because they did not necessarily listen to what exactly people thought they wanted at that time.

But be realistic. Don’t view the world with an idealistic and overly hopeful tone, when the reality of the potential market for your offerings has shrunk or disappeared. Survey the market and be prepared to adjust. The product or service you currently offer may be your dream business, but if things have changed, be ready to shift and adapt to something people actually buy and need.

Visual Feeder, a media tech company specializing in full-motion advertising on high-traffic commercial retail locations, applied this strategy after seeing the impact of the pandemic on their existing model. Most of their clients were physical retail shops that were hard hit by pandemic restrictions. Faced with skyrocketing retail vacancies and a dwindling customer base, Visual Feeder revisited their product and their target market. After realizing that commercial property owners are also losing out on income as retailers exit their brick-and-mortar stores, they shifted their attention from the tenants to the landlords. They turned retail vacancies into an opportunity by marketing their advertising services as a way for landlords to make money out of an otherwise unprofitable situation.

Step 2: Review your capital expenditures

The next thing you need to do is assess whether you are overstaffed or properly staffed for the business moving forward. For example, instead of more waiters maybe you need more motorcycle delivery riders. If your present staff can make the adjustment from waiters to riders, then that’s great. But the painful truth is that you may need to lay off some people, and hire others.

Remember though that each of your employees, especially the hard-working ones who have been with you for a while, may be flexible enough to take on new needed roles. See if you can give them the chance to do so without risking the Company's prospects.

Your spending has to get creative. You can get business partners by selling equity or franchising your business. But with more partners, be prepared for more disagreements over how to do things. Are you the right person for that?

You may think that serving sushi and other food items in your Company canteen may be an unnecessary expense that needs to be cut, but if enough employees feel that it gives them psychological happiness, then consider a cost-benefit analysis. Doing a cost-benefit analysis on your non-core expenses, or those that are optional for the business, is needed during times like these. But being too tight-fisted may also lead to poor employee morale, so use your good sense.

In this sense, you will also have to become more discerning in managing your balance sheet. A healthy mix of steadfast planning, astute cash-flow management, and firm implementation will be your recipe for success.

I sit on the board of a PropTech startup that recently found itself in a precarious financial position. In a nutshell, here’s the three-step approach we took to streamline its capital expenditures:

- Introduced fractional roles and restructured payment terms. We quickly identified that the company’s highest cash spend was on vendor fees for consultants plus C-level professional salaries. To pare down these costs and free up cash for reallocation, we moved from full-time to fractional roles. We also shifted payment structures to vendors from cash only to cash and equity.

- Tied future expenses to revenue milestones. To control cash burn, we decided that any nonessential spending would be contingent on the company’s financial achievements. Say, if they wanted to bring on additional manpower, they would first have to hit an X increase in monthly Actual Revenue.

- Prepared three different budgets based on corresponding board plans. We reinforced the importance of revenue milestones by creating three separate budget plans based on three different scenarios: a conservative forecast, a base forecast, and an optimistic forecast. This painted a tangible picture of the consequences (whether positive or negative) of the company’s future revenue performance to its operations.

Step 3: Explore alternative funding streams

It’s undeniable: loans are harder to get and are more expensive these days because the banks themselves need to pay a higher overnight borrowing rate from the Fed. That said, you may have to revisit and consider different sources to build ample funding.

A cookie-cutter crash course in startup finance outlines the four funding source categories.

In a downturn, equity and debt sources become challenging to access. To circumvent this, a scrappy founding team will need to lean into alternative options through startup platforms and bootstrapping. In my view, grants will be your safest bet as a next priority route from traditional funding sources. If you’re new to startup or small business grants, here are some tips to help you get started:

- Research different avenues such as federal, state, local, or corporate grants. Websites like Grants.gov and GrantWatch.com are good resources for getting in-depth information on these opportunities.

- Identify special eligibilities that may apply to you, your team, or your product — be it by gender, industry, diversity, geography, or something even more specific.

- Most importantly: understand the grant application and approval process. As you might expect, any kind of no-strings-attached capital injection will come with layers of paperwork and processing. Writing your application will be the most important step in all this, so you may need to get grant-writing assistance or take (free) grant-writing classes.

You could also research and cautiously experiment with less common streams or set-ups for additional funding.

| Alt. funding | Pros | Cons |

|---|---|---|

|

Revenue-Based Financing

|

No collateral requirement.

No minimum payment requirements. Flexible repayment schedule. No dilution or change in ownership. |

Requires a strong stream of monthly revenue.

Much lower amounts vs debt and equity financing. |

| Peer-to-peer lending | Typically no collateral requirement.

Typically no prepayment penalties. Minimal paperwork and quick approval through online P2P lending platforms. |

Possible higher interest rate vs. traditional lenders.

Prohibited in certain jurisdictions. Less regulation and no government protection. |

| Opportunity Zone Funding | Viable alternative to bank loans or VC capital injections for distressed businesses

Flexible funding for different startup stages and project scales. |

Only applicable to qualified zones.

Strict requirements and eligibility criteria. |

| Social Impact Funds | Mission-driven than profit-driven.

Typically less motivated by returns and more focused on supporting a social cause. Often comes with more strategic support on top of capital injection (i.e., easier access to investors’ insights and networks). |

Specific to startups addressing a social issue.

More pressure to achieve the desired impact. Risk of drifting from the startup’s mission when pressured to deliver financial returns. |

Stake, a fintech company focused on empowering renters, unlocked more funding through one of the above alternative streams. From the very early stages, Stake was already deeply anchored on its vision of making renting financially rewarding. By using this social purpose as their compass, it earned the trust and support of social impact funds. Beyond the additional funding, Stake also enjoyed the strategic benefits of impact investments. For example, Enterprise Community Partners’ investment in Stake effectuated the formation of the $250M Renter Wealth Creation Fund. Through this program, Stake became a platform through which investors could earn by creating wealth-building opportunities for renters. This shows how funding opportunities are not just capital sources; they also have the potential to help a startup realize its mission.

If all else fails, you may have to rethink funding and be creative. Tapping into your assets might be a viable option, albeit hopefully only as a last resort. Selling unneeded assets, sometimes even personal ones, could be a way to get your business over the hump.

In this scenario, no idea should be ruled out for being too crazy. For example, up-and-coming blockchain technologies can be a way to unlock new streams — some are even experimenting with using NFTs as assets. If there is a way to convert an unconventional asset into funding, do not be afraid to consider it.

There are many ways to raise funding outside of the traditional bank loan or corporate debt or equity that are yet to be discovered. You and your team could be the next pioneers to revolutionize a new funding strategy.

The judgments and choices, the key hires and asset acquisitions, and the partnerships you forge during the hard times may be key in determining your future. In my experience in the frenetic world of startups, it’s these kinds of challenging financial climates that lead to creative decisions — often, ones that will make your team and business better over the long run.

About the author

Zain Jaffer is an accomplished entrepreneur and investor who started his first company at the age of 14. He is the CEO of Zain Ventures, an investment firm with over $100 million in assets under management. Zain Ventures invests in a range of initiatives including real estate, technology start-ups, and private equity.