If you're reading this post, you probably just took our Fundability Assessment. If you haven't, do it first, then come back here.

When investors look at your startup, they don't look at your mockups, your financial models, your user interviews, or your market study. Not really.

They look at your "signals".

This post breaks down the methodology behind the Fundability Assessment and help you find ways to boost your signals, making yourself more fundable.

Let's get to it.

Table of Contents

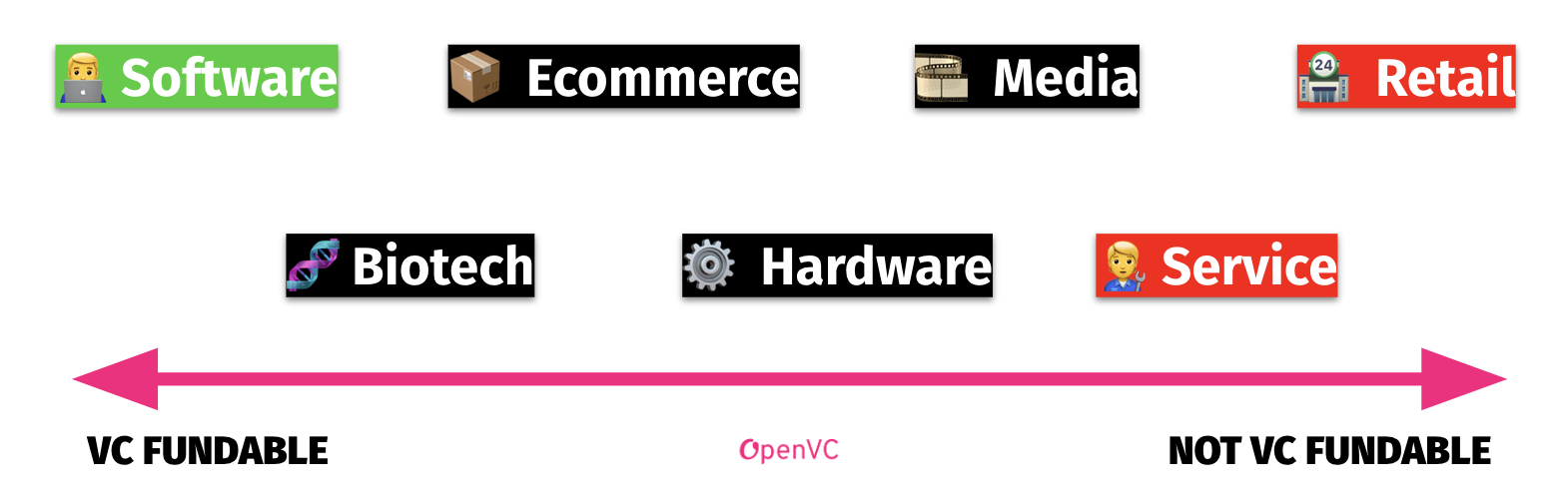

0. Not all companies are VC-backable

1. VCs only invest in a specific type of business

As a general rule, tech VCs don't invest in:

- Service companies e.g. consulting firms

- Brick-and-mortar e.g. restaurants

- Franchises e.g. gym franchises

- Financial firms e.g venture studios

- Mining, farming, real estate...

If your company falls into one of these categories, VCs are probably not the right investors for you. And OpenVC is not the right place for you to raise funds.

To learn more about VC fundability, read this.

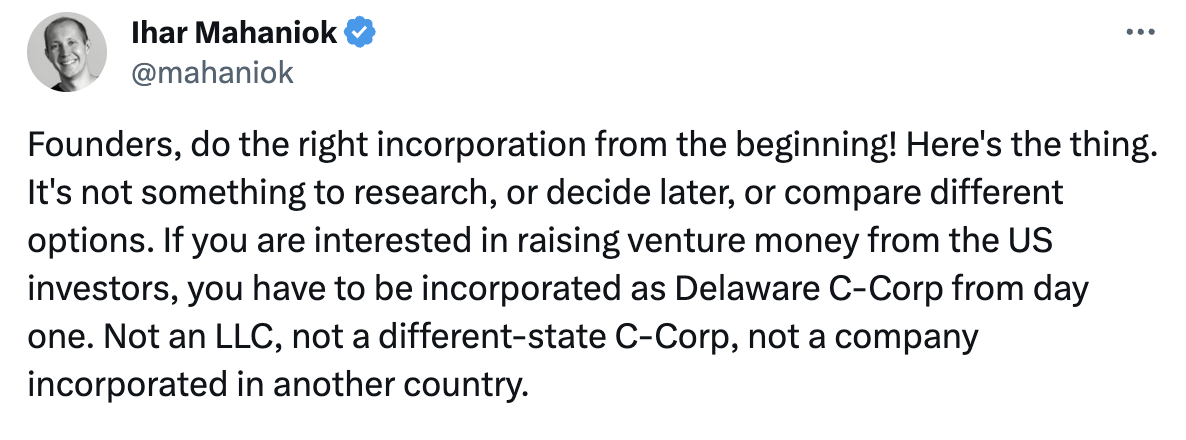

2. US VCs invest in Delaware C-Corps by far and large

If you want to raise from US funds, you should be incorporated as a Delaware C-Corp when you start raising. To learn more about why US VCs invest in Delaware C-Corp, read this.

Outside of the US, VCs still have a preferred legal entity. For example, French VCs invest in SAS (Sociétés Anonymes Simplifiées). Just make sure you comply with the local flavor.

Boost your fundability (+100 points)

If you started as a LLC or S-Corp, flipping to a Delaware C-Corp may be a long, costly process. Make sure to flip before engaging with investors. Otherwise, you will be sending a negative signal. 📛

I. A complementary team with a strong track record

3. Too many founders is a bad signal

A team of two is the default configuration: one tech guy and one business guy (or girl, duh!).

Teams of three or four are not uncommon, but investors would probably double check the value and role of everyone there.

Solo founders are not a bad thing per se, but it's rare that one individual has all the skills to run the show. Which begs the question: why is this founder alone? Is she hard to work with? Or maybe she's not good enough that anybody who knows her would like to join forces?

Teams of 5+ are usually a negative signal. For one thing, it's usually rare to have 5 equally valuable and contributing individuals to co-found a company. For another thing, this spreads the cap table thin and lowers the incentive for everyone involved.

Of course, this is not a hard rule and you have to look at it on a case by case basis.

Boost your Fundability (+7 points)

If you're a founding team of five or more, ask yourself if everyone needs to be a founder. Maybe an advisory or consulting position could make more sense to begin with? 👯

4. A strong biz/tech duo is essential

If you're building a tech company, the typical expectation is that you have a CTO and that he's a founder of the company. Investors will be reluctant to invest if you haven't secured that key position.

Conversely, if you're a tech founder, you should be able to prove that you can run the business side of things, or even better, that you have a business counterpart as a co-founder.

Boost your Fundability (+20 points)

If you are a solo business founder, use no-code tools like Bubble, Adalo, Airtable, etc. to validate your idea. Then use that validation to get a tech co-founder on board. Now, you're ready to fly! 🛫

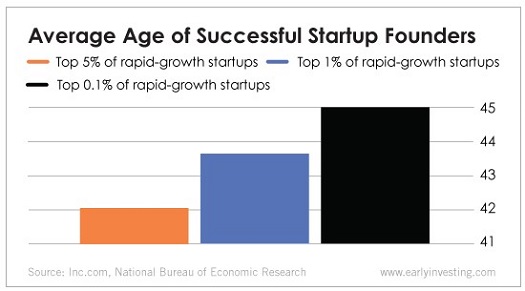

5. Experience matters

As a founder, you are not just a doer, but a leader. You will be accountable to your shareholders, to your employees, and to your customers. If you've never been in a positions of leadership before, the learning curve can be steep for some people. Obviously, investors favor people who've been there before.

Boost your fundability (+0 points)

Well, you can't magically change your resume. There's nothing to "fix" here. However, make sure you have a good legal counsel and a good accountant by your side. This won't bring you extra points, but you'll benefit from their experience! 🤝

6. Exited founders are hot, period

"Past performance does not predict future results", they say. But in VC land, we love looking at past performance. If you've had a significant exit in the past, investors will be very keen to look at your deck.

For 99.9% of founders though, this is not an option and they will have to rely on their other strengths to get some attention.

Boost your Fundability (+0 point)

Just like before, this is not something you can improve overnight. What you can do, however, is try to get an exited founder as an angel investor on your cap table. They are usually solid advisors with strong networks, and you can leverage their aura to attract more capital 😛

7. Knowing the VC game is a big plus

A founder who has previously raised VC money has two advantages. First, she knows the rules of the game, from expectations at each stage to term sheet lingo and valuations rationale. These founders "get it": they understand the game that is being played, won't waste your time, and are easy to work with. Second, these founders have an existing network that they can tap into to get the first few checks. This is a massive plus.

Boost your fundability (+0 points)

Once again, this is a chicken-and-egg situation. Still, if you've never raised funds before, you'd be well-adviser to read up on the topic. Being familiar with the way investors think and talk will lift you up from the bottom 50% of founders. 🤓

To learn more about the VC game, read this.

II. Enough product to derisk the tech

8. Investors rarely fund ideas

Investors like to say that "nothing is too early" and that they "want to be the first check in". This may be true with proven founders that have a successful track record. But don't be fooled - unless you have an MVP, the large majority of professional investors won't consider an investment.

Building a product is a risk. You may build it too expensive, you may build it wrong, you may just not build it at all. Investors like to think their money is invested in the growth of the company - user growth, revenue growth -, not in building an unproven figment of someone's imagination.

Boost your fundability (+7 points)

As long as you're building vanilla software (eg 95% of startups), a part-time CTO and low-code tools should be enough to go from idea to MVP. Just make sure that you can bootstrap until you have a MVP, even if it means freelancing or keeping a day job on the side. 💸

To learn more about building a MVP without tech skills, read this.

9. There are only two sides to the barrier to entry

Having a banking license can be a massive barrier to entry for your competitors. But until you have one, it's mostly a massive barrier for you to get funding, because investors may be too afraid that you never get a license in the first place.

Boost your fundability (+0 points)

A shortcut to get a license consists in acquiring a failing business that has such a license. In some cases, you can also partner with a licensed entity for a fee. That's typically the case for a broker-dealer license. 📜

10. Deeptech, hardtech, pharma startups have more to prove

If you think software startups are hard, don't try deeptech, biotech, or pharma. They are their own special versions of hell. Not only very few investors actually invest in these spaces, but you will also have to deal with your good friends at the FDA or their local counterparts. Clinical tests are a massive endeavor that span over years and encompass a ton of risk. You better be ready.

Boost your Fundability (+20 points)

If you're building a IP-heavy company, your initial source of funding will be grants and subsidies. Build connections with VCs, but postpone raising until you've secured key patents and demonstrated the core tech - you would be wasting your time otherwise. 🔬

III. Traction trumps everything

11. Post-revenue, aim for 10% MoM revenue growth at least

Once you're post-revenue, say past USD $5k per month, investors will focus their attention on month-over-month revenue growth. As a rule of thumb, two-digit MoM growth is the minimum to be considered fundable, but 20% is where investors get excited, and anything above 40% MoM makes you king of the hills.

Boost your fundability (+10 points)

If revenue is not growing fast enough, and provided you're small enough, advertise yourself as pre-revenue. That way, you're selling the vision, not the numbers. Don't take it from me, take it from Russ. ❜❜❜

12. Pre-revenue, show a exciting pipeline or strong user growth

If you are pre-revenue, investors may want to look at your weighted sales pipeline over the next 12 months. This is typical for enterprise startups with long sales cycles and large contract value. Numbers are hard to come by, so I'd love to hear investors' opinions here (email me at [email protected]).

In other cases, it makes more sense to look at monthly active users (MAU). This is the case when your model relies on reaching a critical mass of users before monetizing e.g. social media, adtech, marketplaces. Here, just like with revenue growth, two digits is a minimum.

Boost your Fundability (+20 points)

If you are an unproven team, raising funds without traction will be hard. If you can delay the fundraising until you have some traction, you'll greatly improve your odds. 📈

IV. Give yourself favorable funding conditions

13. The first few checks are everything

Raising funds is an asymmetrical process. The first 25% is incredibly hard while the last 25% is incredibly easy. Most investors are just "followers" - they wait until a "lead" investor has done their due diligence, negotiated the terms, and committed 25%+ of the round, then they jump in.

As a founder, it means that even if a fund likes you, there's a high probability that they don't lead, and therefore won't put down 1 cent until someone else has. So any founder that has already secured that lead investor is in a much, much better place to close their round.

Boost your Fundability (+20 points)

If you're raising with SAFE, use high-resolution fundraising: give better terms to the first few investors, reward them for saying "yes" faster, and get those first checks in. 💰

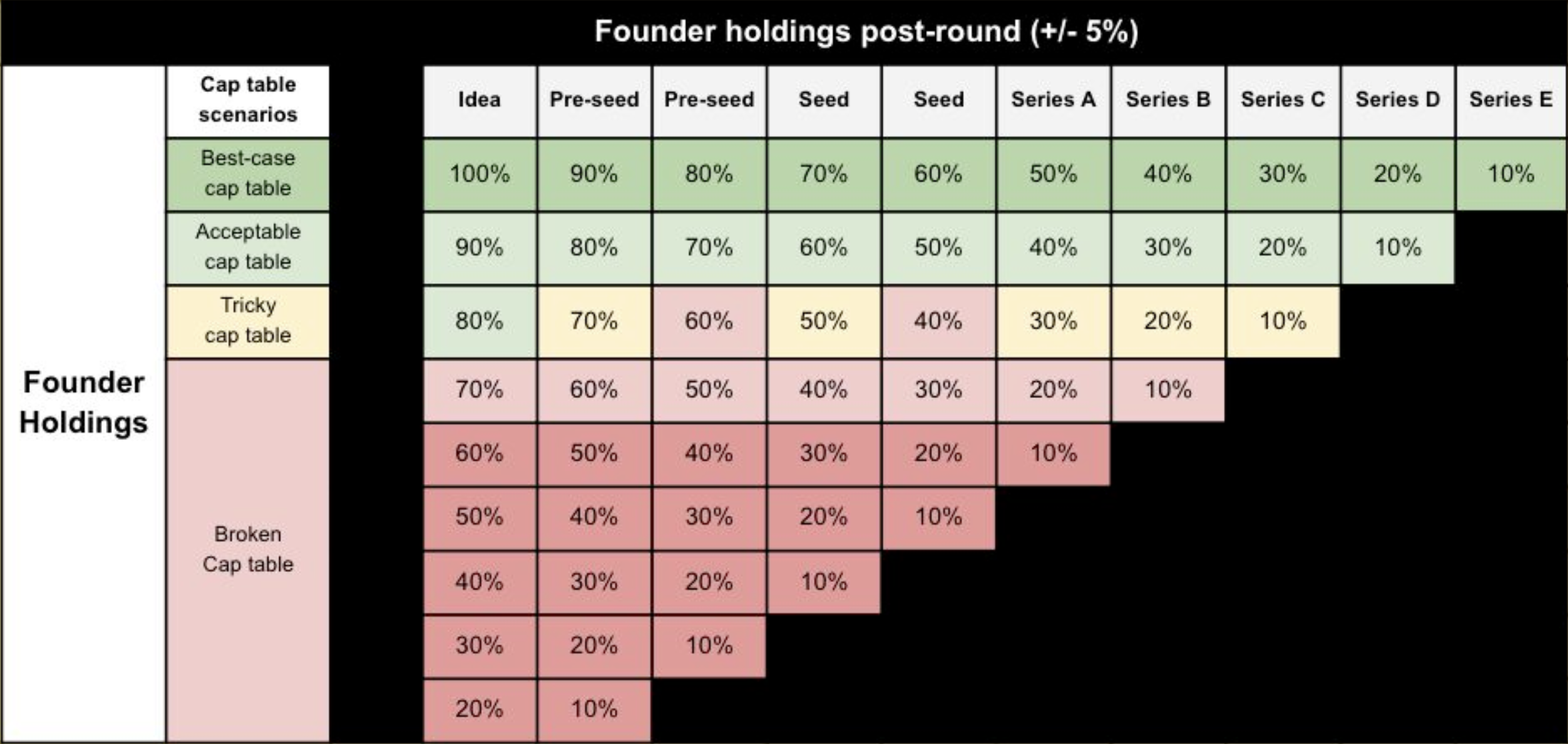

14. Not owning enough equity is a funding killer

Investors understand the power of ownership. Therefore, they also understand that if the founders don't have enough equity in their own company, they are likely to lose their drive to grow it into a billion-dollar business.

As a reference point, founders should collectively own at least 70% of the company after seed round, or at least 50% of the company after Series A.

Boost your Fundability (+20 points)

If you cannot answer "Yes" to that question, then you probably need to have a conversation with your existing investors. Reshuffling the cap table at their expense might be the only way for the company to move forward - and that their equity won't be worth much otherwise. 🫤

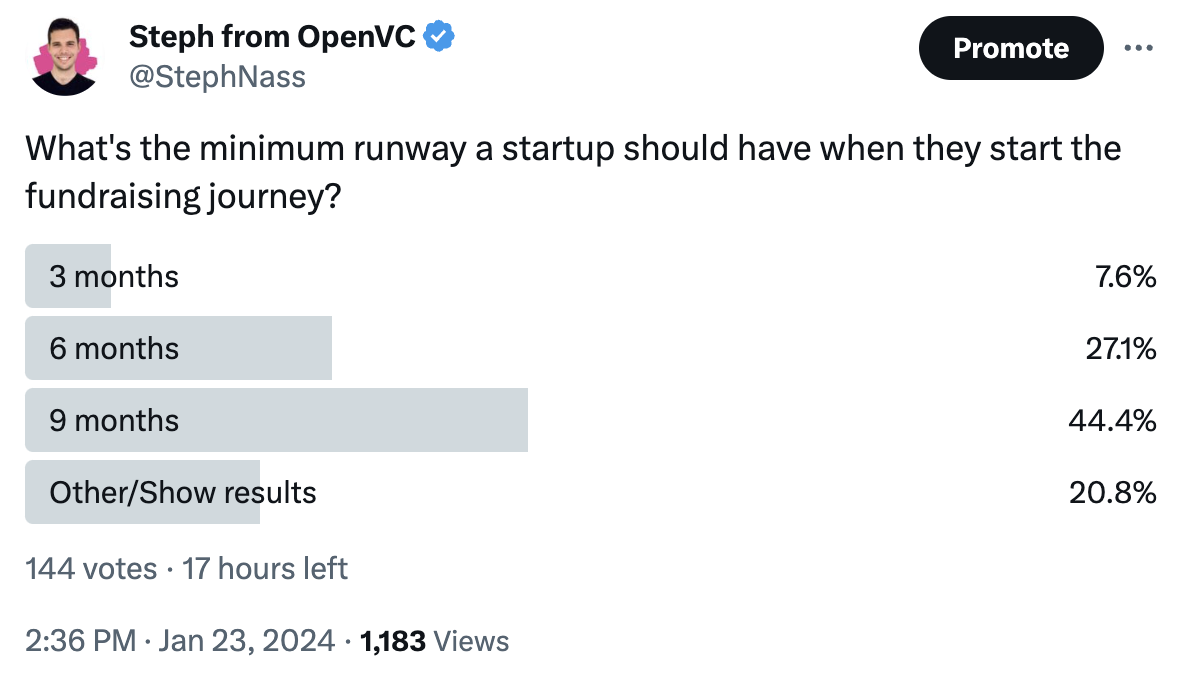

15. Secure at least 6 months of runway

Assuming 0% of the round is secured, you want to have at least 6 months of runway to get a few term sheets, find your lead, and raise funds in good conditions. Anything under that and you run the risk of being cash-strapped, desperate - and nobody wants to invest in a desperate founder.

Boost your Fundability (+10 points)

If you need to extend your runway, don't wait up to cut costs. As a general rule, you should aim for "default alive" - meaning that even if no investor invests, the company can still find a path to profitability on its own. Fundraising should not be an obligation but a choice. ⏳

Understanding your results

Before diving into the results, a few disclaimers are needed:

- This Assessment has no scientific basis. It's just us trying to make sense of the heuristics commonly used by investors.

- This Assessment doesn't say if you have a good or bad business. It only says if you have the signals that get investors excited - for better and for worse.

- This Assessment is fundamentally unfair. It is biased against first-time founders and against underrepresented founders, because it reflects the biases of the industry.

Now that this is out of the way, here are the four possible results:

- 74 points and above: Outstanding 😳 You will certainly raise from local VCs and angels. You may even raise from tier 1 VC firms. You probably don't need to go through an accelerator. You probably don't need to raise from family & friends.

- 62 to 74 points: Solid 😏 You will probably raise from local VCs and angels. Accelerators are an option, but not essential. You probably don't need to raise from family & friends.

- 56 to 62 points: Not bad 😊 Raising from local VCs and angels may be possible with existing connections, difficult otherwise. Improve your odds by bootstrapping some more and/or joining an accelerator.

- 56 points and below: It's complicated... 😅 Maybe beef up your team, product, and traction first? An incubator or accelerator can help with that. You may also raise from family and friends.

Let's say that your score is low. What now?

- You may try to "borrow signal" by joining a world-class accelerator, bringing a top personality on board as an advisor, or crafting a great narrative and boosting it with PR. Some founders are really good at engineering FOMO, and sometimes it works.

-

More importantly, you should improve your fundamentals: better team, better product, better traction, etc. In other words, don't raise now, but bootstrap until your score goes up.

This is not what most founders want to hear. You have a great vision, you may have already left your day job and gone full-time, and you need that funding to hire a developer or pay yourself a living wage, and get things off the ground.

But unless you have an impressive track record and/or a lead investor secured, this won't happen. The realistic thing to do is figuring out a way to extend your runway and build up your team, product, and traction until eventually, you are fundable.

And yes, it sucks.

The Fundability Assessment is a work in progress.

If you see ways we can improve it, please email me at [email protected].