Welcome, investor!

In 5 minutes, you will know exactly how to use OpenVC to access quality, qualified deals.

Table of Contents

What is OpenVC and is it right for me?

OpenVC allows tech investors to directly connect with founders.

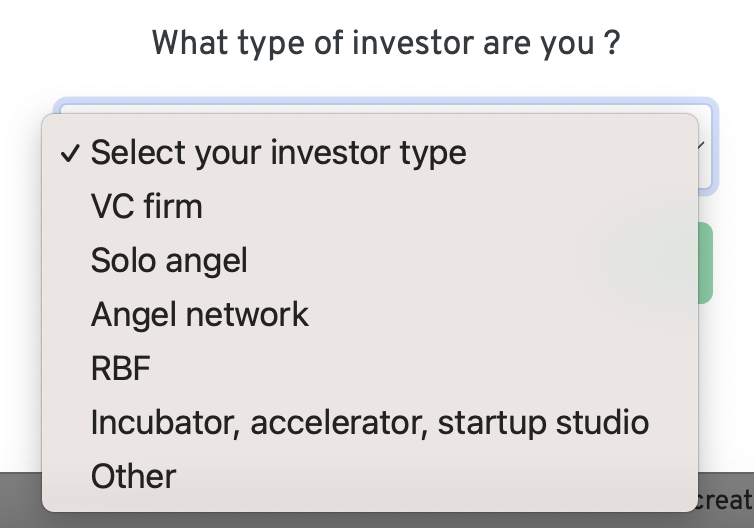

If you are a VC firm, angel investor, startup incubator or accelerator, startup studio, then OpenVC is right for you. We also welcome RBF and debt providers, as well as "free money" (grants and subsidies).

Our service is completely free - no commission, no subscription. We monetize via premium features and advertising.

NB: If you're a service vendor or software vendor, don't sign up to the investor list - you will be rejected. Instead, contact [email protected] and we can add you to our Perks marketplace.

How to sign up and get started

Go to OpenVC.app. Click "Sign up", then "I'm an investor", and select your investor type (VC, angel, accelerator...).

If you're an angel investor:

- Fill in your personal information and click next to receive the activation email

- Go to your mailbox, click the activation link, and log in to OpenVC for the first time

- When you log in, make sure to fill all your profile information, including countries of investment, check size, and thesis. If you leave these fields empty, we will not be able to send you deal flow!

- We also suggest that you include your Linkedin profile, photo and some portfolio companies to help founders get a sense of whether this is a good fit.

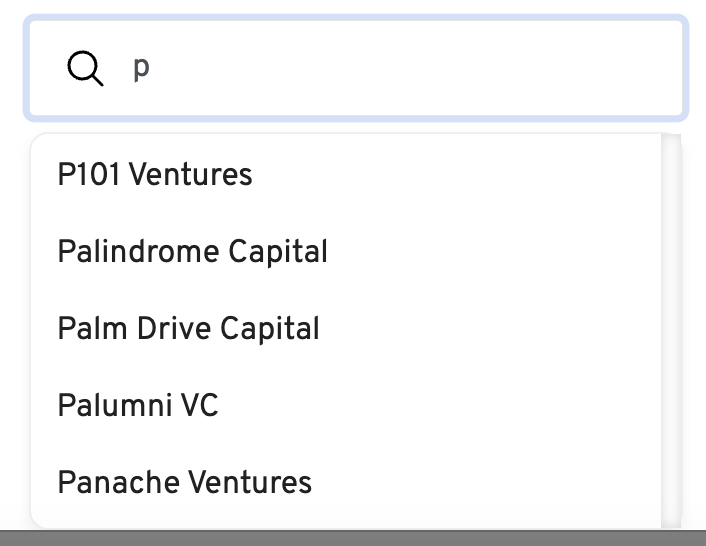

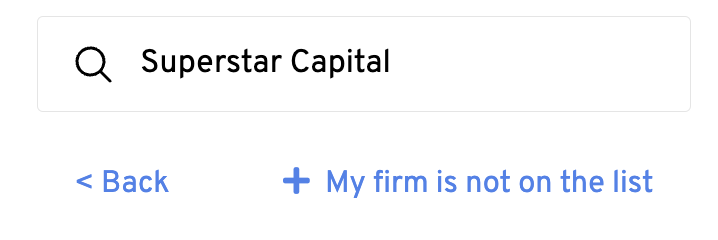

If you're not an angel investor, you have to pick whether to join a new firm or join an existing one.

- Join an existing firm if it's available in the list. It means that a colleague of yours has already created an OpenVC profile. When signing up, make sure to use your professional email address so we can expedite the validation process. Any questions, contact [email protected].

- Create a new firm if it's not available in the list. We will review your fund application and approve it within 24-48 hours. Once your fund is created, you will have to go through the signup process once again to create a personal account. Then, you will be all set.

How to receive deal flow from OpenVC

1. Whitelist [email protected]

All deal flow will be sent to you from [email protected]. If you're not receiving deal flow, it's 99% because you haven't whitelisted the address.

Not sure how to whitelist an email? Here's a 2-min tutorial.

2. Activate "Direct email"

OpenVC gives you 2 or 3 options to receive deal flow:

- Intro preferred: Founders will see you on the platform, but will be unable to email you or contact you. They will be redirected to your Linkedin profile and encouraged to find an intro to you.

- Online form: Founders are redirected to an online form that you provide, usually a Typeform, Airtable Form or similar. This allows you to capture deal flow directly in your CRM. This option is not available for angel investors right now.

- Email address: Founders can directly email you via our emailing system. Your email address is not publicly visible. We screen every email and gently reject the deals that are too bad or completely out of scope. We also cap your deal flow to 2 deals/week, so you never get overwhelmed.

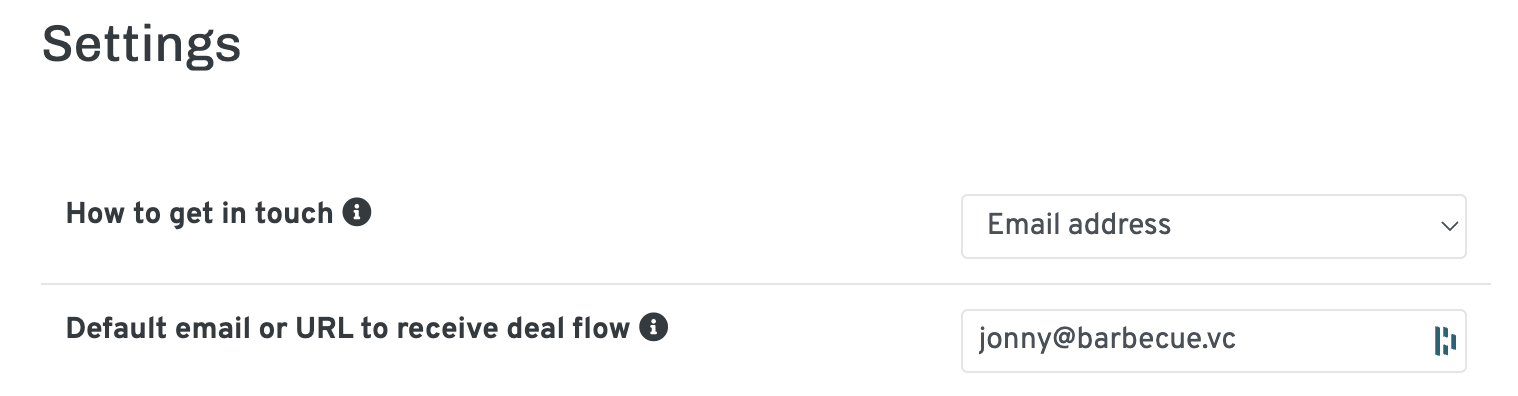

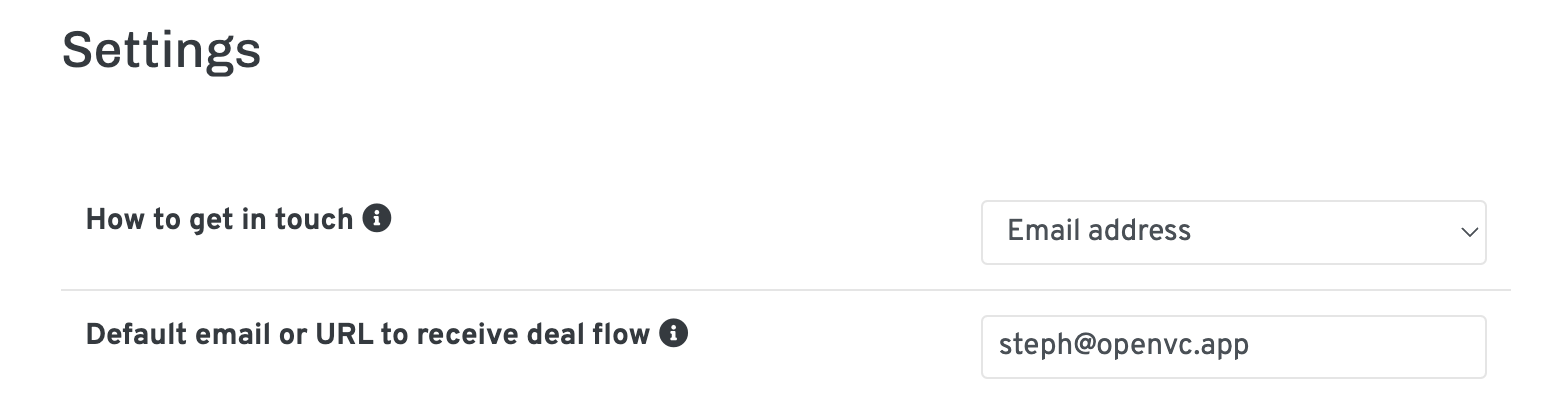

To activate direct email, log in to your OpenVC account, then click your profile picture, then "My profile", click "Edit profile", and change the Settings "How to get in touch".

We recommend starting with "Email address" and fine-tuning things down the road. Any questions, contact us at [email protected].

3. Optimize your OpenVC profile

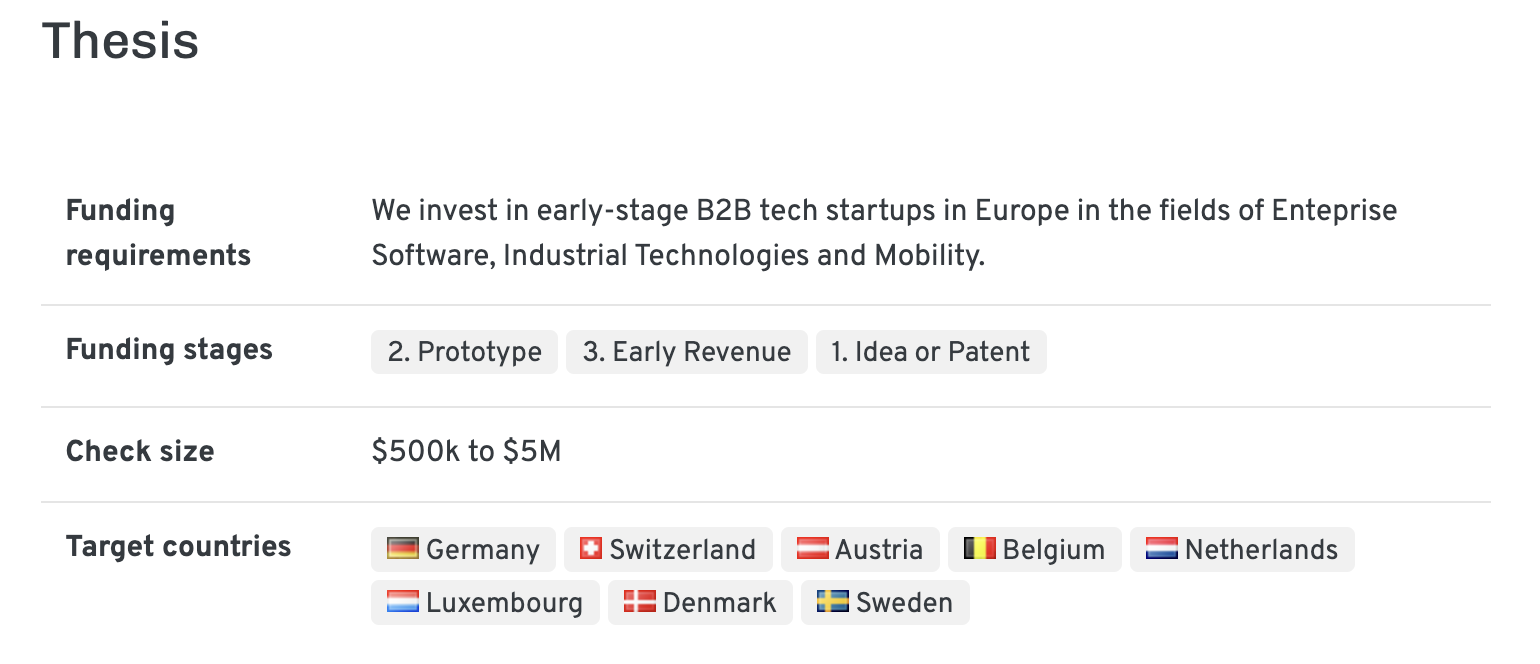

If you don't receive deal flow, or if your deal flow is poorly qualified, it's probably because your OpenVC thesis is not optimized.

Here are a few points to pay attention to:

- If you say that you invest at Idea stage, you WILL receive idea stage decks. Make sure you are comfortable with that.

- Target countries are the countries where the startup are incorporated. It may lead to false positives, for example when a startup is headquartered in Singapore but sells in Bangladesh, or when a startup is headquartered in the UK but sells in Nigeria. We're working on improving this.

- Keep your target countries under 10. Just focus on the countries where you're really the most active and involved.

- Use specific keywords in the " Funding requirements" field. Our search engine is keyword-based, so it's absolutely fine to "stuff" keywords to get relevant deal flow. For example,

- Don't say that you are "agnostic" or that you "invest in tech". Do you invest in Biotech? Deeptech? Cannabis? Web3? Hardware? Porn? Probably not. Be specific about what you invest in, otherwise you will receive out-of-scope deals.

- Add in more requirements such as MRR or founder profiles. If you don't invest under 30k MRR, say so. If you focus on female founders, same. Otherwise, you will receive out-of-scope deals.

The more specific you are, the better deal flow we can send you.

How to access top 1% deals on OpenVC

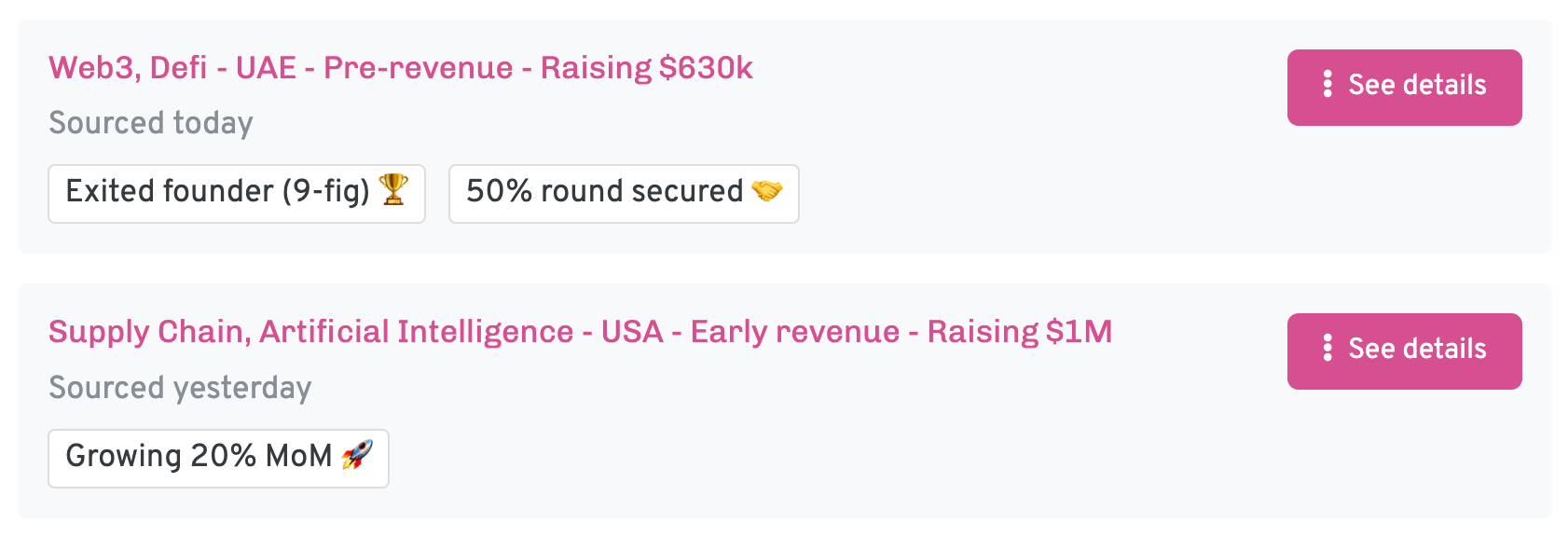

We have recently soft launched OpenVC Flow.

OpenVC Flow allows you to directly request decks from top 1% rounds before they close. This include startups with exited founders and/or hypergrowth and/or significant funding secured.

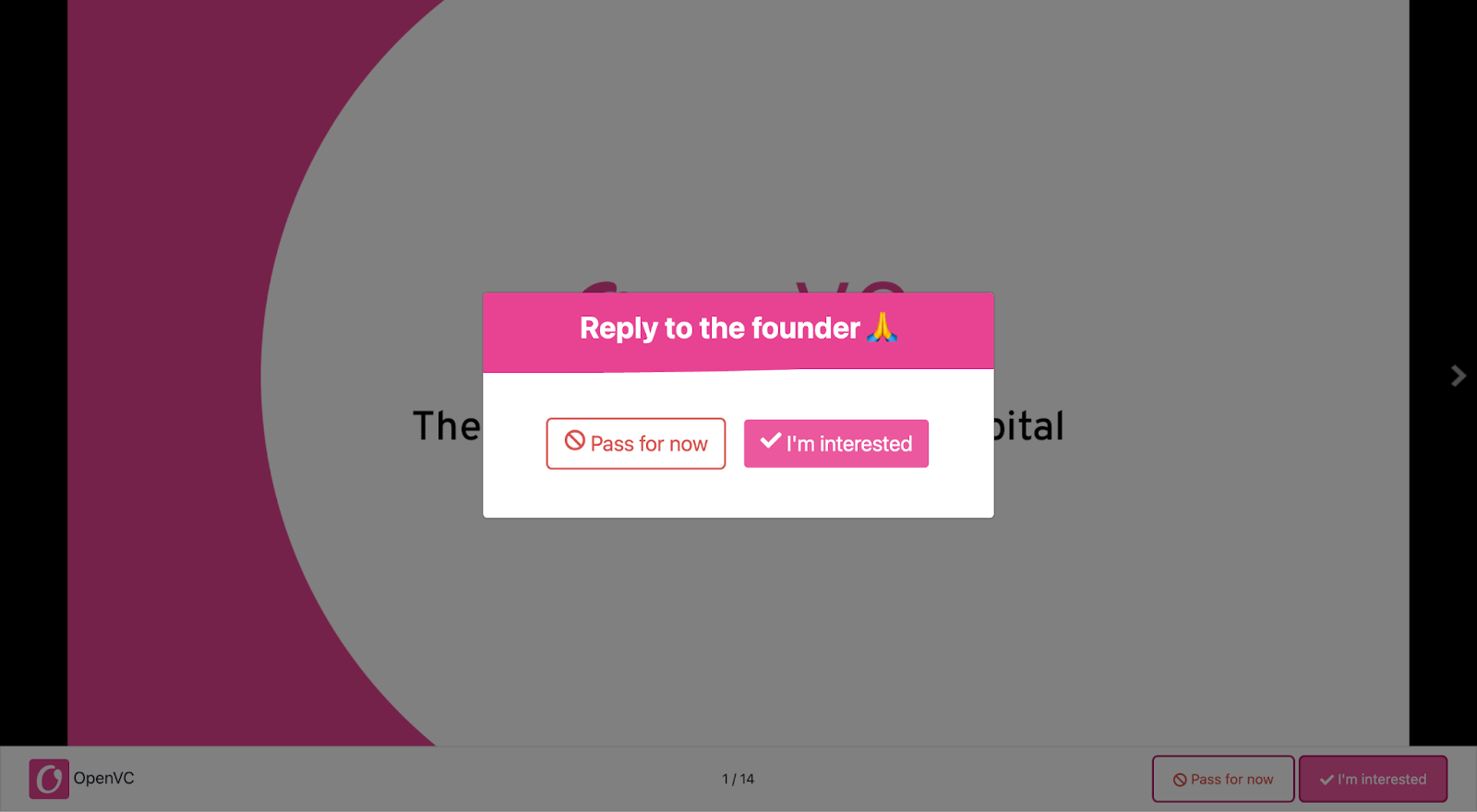

To access these top deals, log in to OpenVC with a investor account, then head to the Flow page and follow the steps. Currently, investors are limited to 3 requests/day to prevent abuse.

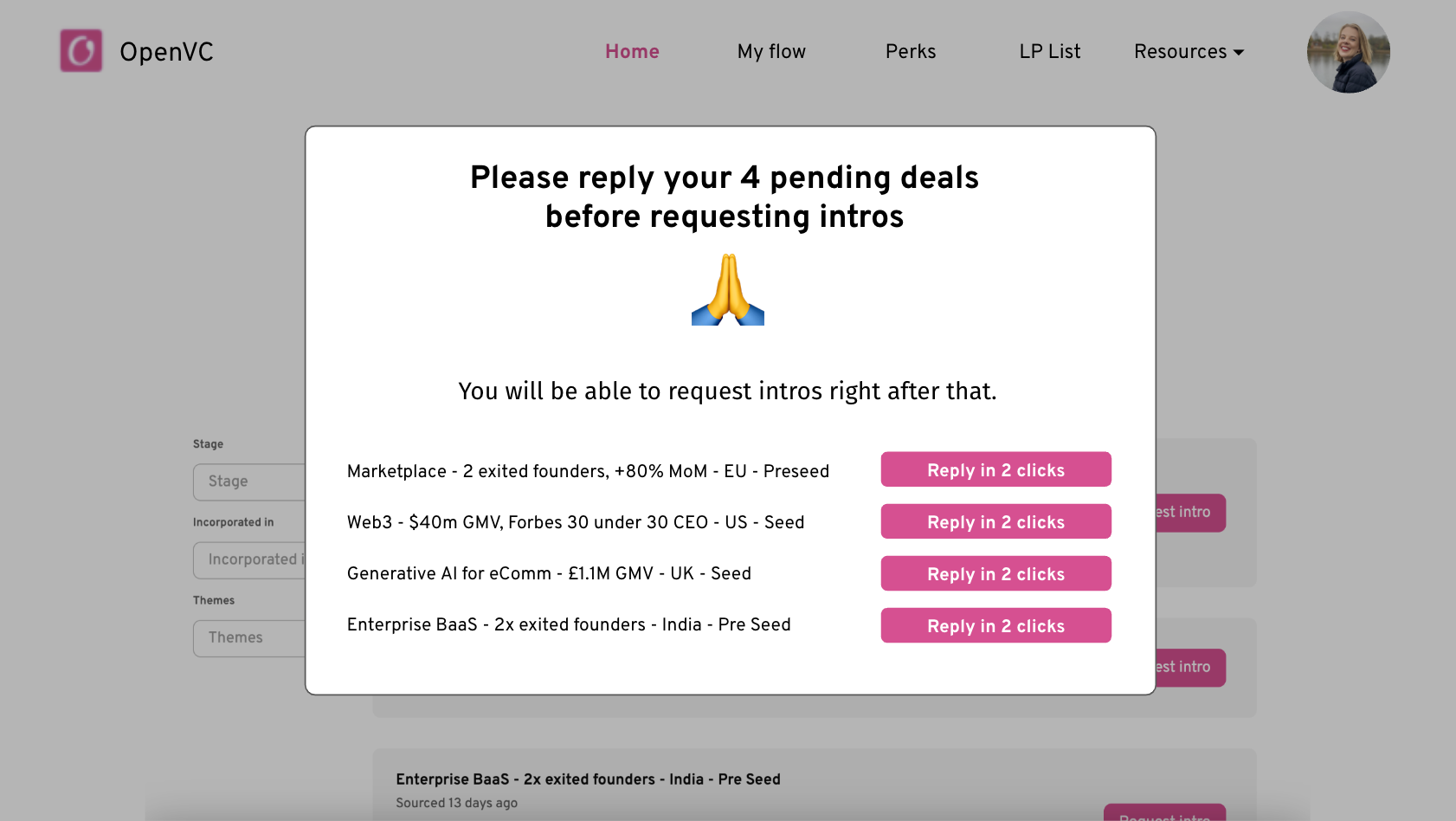

This feature is free, but if you have previously unanswered decks, you be prompted to reply them before being able to request more decks.

Another important point: when you use the "Request deck" feature, your OpenVC profile will be automatically updated to accept cold emails. This is necessary to make sure that you receive the deck you requested.

You can always manually revert back to "Intro preferred" in your Settings:

How to improve your Reply rate

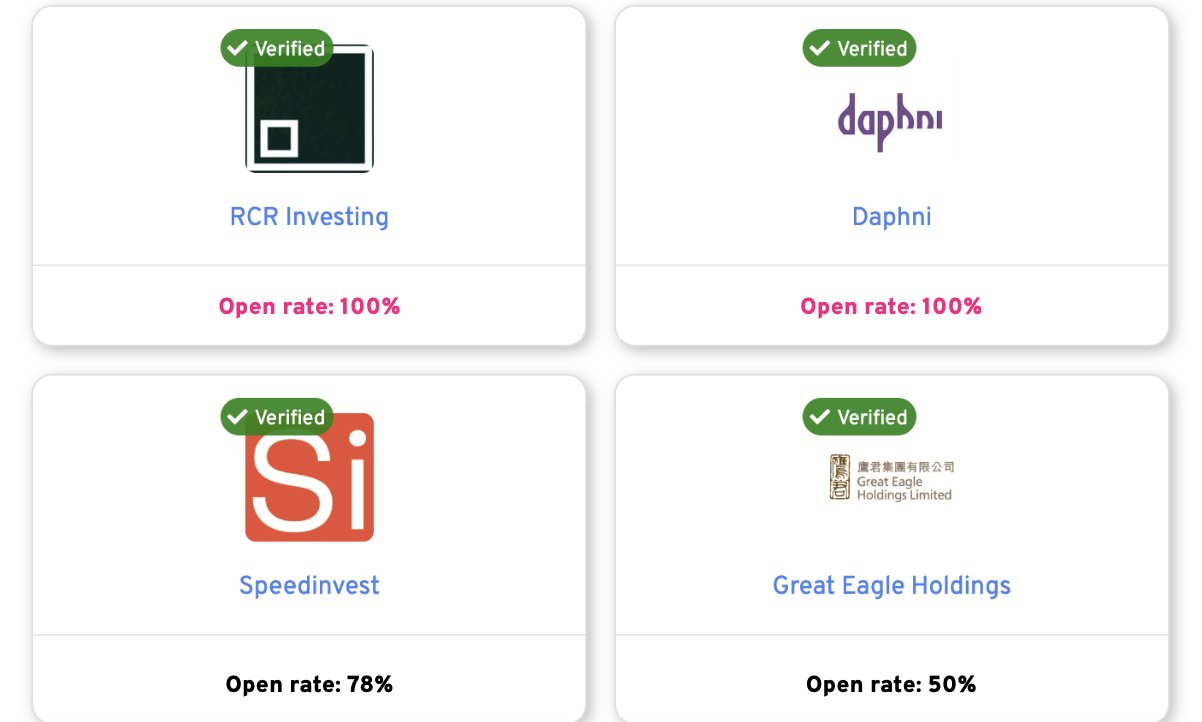

Every firm and investor on OpenVC has an Open Rate and a Reply Rate.

How do we collect that data?

When a founder uses the OpenVC deck viewer, we track whether the investor opens the deck and whether the investor replies to the founder by clicking the Reply buttons. Then we compile these stats over the past 30 days.

So if you want to boost your metrics, just open the decks and reply with the two buttons 😉

Right now, we're slowly rolling out those metrics on different pages of the app, so you may not see them in your interface.

I have more questions about OpenVC

OpenVC is a young project and we need your feedback to improve!

Please email us at [email protected] to share your thoughts. We try to reply within 24 hours.

Thank you for using OpenVC!