Yesterday, famous VC Jason Lemkin passed on a startup because the deck was dated from 2 months ago, which he saw as a negative signal.

Of course, people on Twitter and Linkedin got riled up.

Let me tell you why (a) Jason did nothing wrong, and (b) most founders have the wrong expectations when it comes to VC relationships.

NB: This is an "opinion piece", slightly different from our usual educational content. Feel free to say if you hate it or love it on Twitter and LinkedIn 😁

Table of Contents

First, let's get the facts straight

Here's the full tweet that caused the outrage:

So, Jason opens a cold email. The deal seems decent, but not that exciting. Then, he notices that the date on the cover is outdated. Small detail? Yes, but also a red flag that tips the scale. Jason passes.

Congratulations, you just got introduced to the VC "game of inches".

Signaling and red flags: VCs play a game of inches

Founders may be horrified, but look at the investor's point of view.

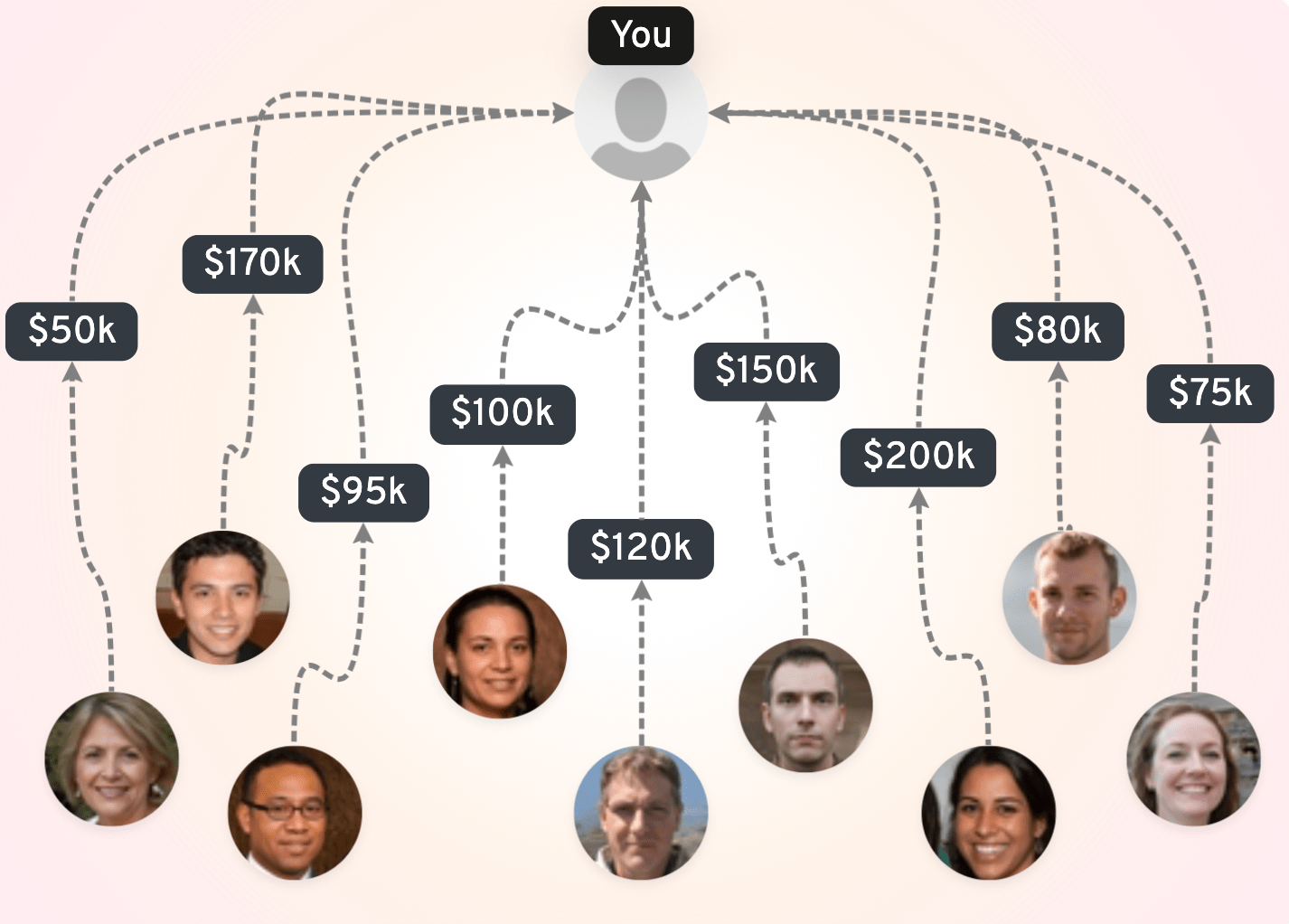

A VC receives 10 to 50 decks per week. Out of those, 10% are hot: think OpenAI. These deals don't even need a deck to raise. They thrive on FOMO, it's a pool party. VCs fight for allocation on those cap tables.

Then there's the rest.

The bottom 90%. The normal founders. You and I.

For these ones, it's an elimination process: kill as many decks as fast as possible. Whatever remains gets a second look.

This is where "red flags" come into play. Because VCs have zero context on a cold email, they rely on micro-signals:

- "Market size is $200Tn" -> Founder is naive or delusional

- Lots of text written small -> Founder has low empathy, poor marketing skills

- The deck is outdated -> Founder has low attention to details

- Etc etc.

(By the way, the OpenVC pitch deck tutorial explicitly says to never include the date on your cover. If you haven't read it, it's free and available to all founders here ).

Unlock the secrets to startup fundraising 🚀

Use our FREE, expert-backed playbook to define your valuation, build VC connections, and secure capital faster.

Access now

Don't fall for the fleece vest: VCs aren't your friends

If you listen to VCs, they are your friends.

"We want to be the first check in." "We add value" 'We are responsible investors". "We're in for the long run". "We back outliers" and the oh-so-famous "Let me know how I can be helpful".

That's normal, that's part of their brand building.

VCs want to see as many deals as possible. Even if they barely open your deck, they want to increase their "coverage rate" and report a growing top of funnel to their LPs.

Founders however, especially first-time founders, rarely get that nuance. They want to believe that there's a bunch of nice people who will support their journey with advice, cheers, and yes, money.

This is partly true. Most VCs I've met - and I've met 100+ at this point - are good human beings and diligent professionals.

But they remain money allocators. Don't be fooled by the Allbirds, the fleece vest, and the Twitter threads. VCs are investors. They manage millions of dollars, report to their own investors (the LPs) and if they don't deliver the expected returns, they won't raise their next fund.

As much as they want to be your friends, the fund comes first (as it should).

Jason did nothing wrong?

This brings us back to Jason Lemkin's post.

I actually believe Jason's post to be sincere and helpful.

For one thing, he is one the few who actually opens cold emails, replies to them, and invests in them. He famously funded Algolia, Pipedrive, Salesloft, and Talkdesk on a cold email.

He also openly shares his decision-making process, which is rare and valuable. Think about it: investment bankers and experienced founders know better than sending an outdated deck. Now, outsiders know about this, too.

That's why I believe Jason did nothing wrong.

He just gave founders a sense of how ruthless and biased the selection process can be. A few founders got offended, but many more learnt from it and adjusted their decks accordingly.

All in all, it's a net positive.

Find the right distance with VCs

I work with first-time founders on a daily basis.

I've noticed a typical emotional journey from excitement (pre-raise) to frustration (1-2 months into the raise) to downright anger (3+ months) when they realize VCs don't open their decks, don't reply to their emails, and don't provide any feedback.

I believe this is due to wrong expectations.

If you've never dealt with professional investors, this is something you have to learn.

VCs aren't your teachers nor your managers. They don't have an obligation to provide feedback or even to reply to your emails. They won't give you a second chance. They won't coach you so you can do better next time.

Instead, think of a VC as a sales prospect.

They have been pitched 10 times and are jaded. They are irrational and demanding. If you want to close that deal, you need to bring your A game, especially if you're an "almost" deal.

Of course, you can also decide that belly dancing for VCs is not your thing and go another route like bootstrapping. Perfectly reasonable.

Simply remember: VCs are investment professionals before being a founder's best friend.

Find your ideal investors now 🚀

Browse 5,000+ investors, share your pitch deck, and manage replies - all for free.

Get Started