Congratulations! You are the CEO of a start-up and have graduated to seed funding and beyond from professional investors. This likely means you have gained a board composed of investor representatives, founders and perhaps independents. Typically, having new blood around the table coupled with a sense of validation that your start-up is viable and has a reason to exist infuses the first couple of board meetings post-financing with energy, optimism and excitement about the future.

However, as the novelty of the financing fades, daily challenges of building a successful business take center stage, investor interests surface and personalities emerge. When managed well, the board can be your company’s greatest ally and when not, it can be detrimental to its success.

Here are some tips on how to pre-empt unnecessary, time-consuming complexities and get the most out of your board.

Table of Contents

1. Understand the key role of the board.

Broadly speaking, the board is a body of representatives appointed by shareholders responsible for assisting with company decisions related to governance, strategy, financial management, executive hiring and firing and other decisions that have significant influence on the business. Stated very simply, the board is the CEO’s boss that helps to steer the company and not just a legal formality.

2. Constructing the board. No cookie cutter solution.

When considering how to construct your ideal board, there is no single ‘right’ answer as you do not have complete control on this process but you do have a lot of influence. There are multiple nuances to consider such as industry, amount of capital raised, number of investors, size of the founding team etc. and board composition will change over time as the company evolves. Some key things to bear in mind:

- Board Size: Keep it small but not only limited to founders once the company has reached seed+ stage (first institutional round and beyond). It may be tempting to keep everything amongst founders, but this can lead to drinking one’s own kool-aid for too long and in some cases to really unethical behavior. Size will vary as the company matures but the general rule of thumb is 3-5 members for seed-B and 5-7 for C+.

- Socialize: Try to get to know the prospective board members for months in advance of a potential appointment. Build trust and a rhythm of communication. If this member will be appointed by a fund, try to get to know multiple partners in the fund. Having broad buy-in at a fund will benefit the company in investment committee discussions about current, subsequent financings and in the case your main contact departs.

- Long-term partnership: When adding new board members, have a good sense of strengths and weaknesses and if this is someone you want to work with for many years to come. Most start-ups that reach an exit have a longer tenure than the average marriage! This is a long term partnership and getting divorced is almost impossible.

- Reference check: Reference check the prospective board member through back channels. If this is a member to be appointed by an investor, speak to founders in the portfolio that have worked with this person (not only the ones noted on the reference list) and if an independent appointee, speak to CEOs of other boards they have served on, executives they have worked with / coached.

- Target domain experts (or those who are avid and agile learners): Be wary of investors looking to ‘dip their toes’ in domains beyond their core competence (e.g., cyber security focused fund pursuing a climate tech opportunity). The benchmark of such a board member will be a different industry characterized by dynamics, GTM, business models and time horizons that have nothing to do with your target industry. If you do raise capital from such an investor, the burden is on you to deeply and regularly educate that board member about the ABCs of your business and industry to ensure that your company will be measured against a relevant cohort. If you do not do this, the feedback during the board discussions will be off-mark, wasting time and creating a lot of antagonism.

- Believers & Evangelists: Try to identify people that believe in your mission, your ability to execute and who will become the company’s evangelists. Do not confuse this with board members who are ‘soft’ and will just go with the flow - these individuals are typically not damaging but also not useful in taking your company to the next level. Rather, seek out personas that ‘get it’ during the first pitch, want to dive in deep and become an expert, have immense belief in you but will challenge you when you need to be challenged and coach you to help you execute on the promise.

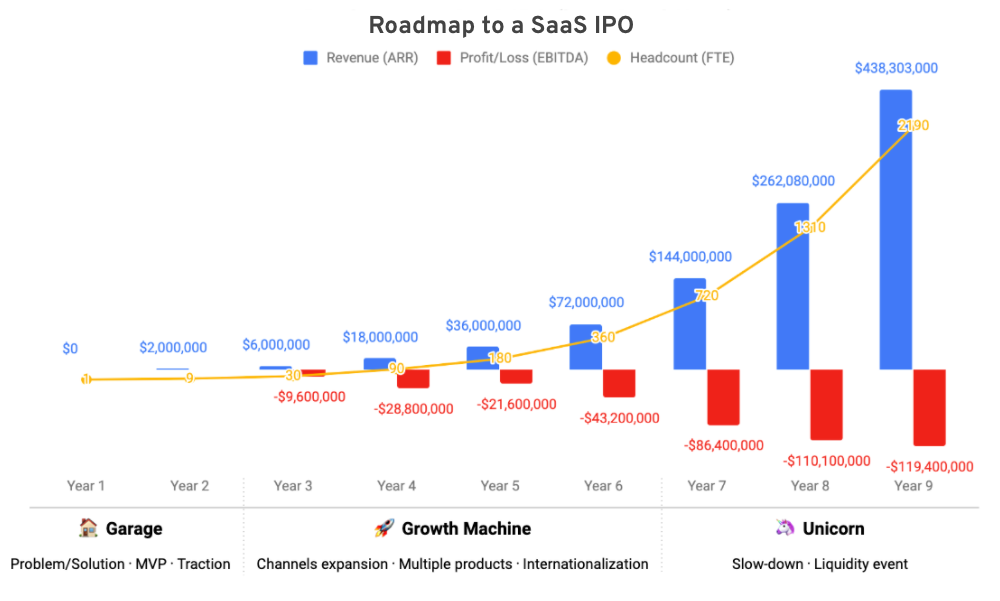

One take on board size / construction as companies mature.

3. Build a 1x1 relationship with each board member.

Be cognizant of the fact that collectively the board is your boss and individually, each board member is a fractional boss. Just as you expect your employees to regularly update you and understand your objectives and motivations, you should do the same with each one of your board members. Schedule routine off-board cycle meetings (these can be a quick coffee or chat or a quarterly meeting) to gauge what drives a board member’s behavior whether that be a passion or concern about your business or their fund’s portfolio management considerations. Understanding the underlying behavior triggers will better equip you to address issues and mitigate potential blow-ups. These 1x1 individual meetings not only provide a setting to hear unfiltered feedback but also an opportunity to develop a personal, trusting relationship and demonstrate that you value that board member’s perspectives.

I can tell you how bad our boards are... I don't have to watch Saturday Night Live anymore; I just go to the board meetings. – Carl Icahn, Icahn Enterprises

4. Create a group dynamic within the board.

Not less important than having a strong personal relationship with each of your board members is cultivating good relationships amongst board members. Once or twice a year, organize a F2F board meeting followed with a dinner, drinks or something socially oriented. This does not have to be a high budget event, just do something fun where people can talk business and pleasure with your company being the common thread.

5. Proactively seek advice.

As a CEO and especially as a first time CEO, you will be doing multiple things every day for the first time. If you have high IQ and EQ, you will genuinely and proactively seek out feedback and advice from your board members on certain topics. This is not intended to open the door for the board to micro-manage the company but to enable you to take advantage of experience and data that will empower you to make the best decision at any given moment. Remember that pushback is not the enemy but rather an opportunity for you to sanity check your thoughts and instincts before making important decisions. Engaging your board members on some of the more critical decisions, listening to experienced points of view, assessing that information before landing on your final decision is likely to improve your decision-making skills and go a long way towards fostering healthy and productive dynamics with your board members.

“None of us is as smart as all of us.”- Ken Blanchard, Author & Leadership Expert

6. Identify individual board member’s strengths and capitalize on them.

Every board member comes with experience and expertise in business and life. View each board member not only as your boss but as a potential mentor or coach. Be a detective, identify each of their strengths that can drive value for the company, for you as a leader or even for your management team. Make it a priority to proactively leverage the respective skills and knowledge of each member to the benefit of the company. This is your opportunity to put your board members to work for you and make them part of the team. By doing so, you can increase buy-in, accountability and a personal vested interest in the success of the company. Most will appreciate a very specific assignment or task rather than searching for random ways to assist you.

“Make sure every board member has a distinct job. Build your board as a team, just like you would build your executive team.” Zack Rosen, CEO, Pantheon.io

7. Transform your board into an extension of your sales team.

Every single board member should be able to recite your company’s elevator pitch (and more) in their sleep. It is your responsibility to equip them to do so, keeping them updated on the narrative and providing accessible, up to date collaterals at all times (e.g., one-pagers, intro decks, email intro blurbs). You should transform each board member into your biggest cheerleader and advocate vis-a-vis the relevant stakeholders they engage with from investors, potential customers to strategic advisors. Your job is to simultaneously collect constructive feedback from your board while also ensuring these individuals will consistently rally around the company, cheer it on and have its objectives top of mind at all times.

Ravi Gupta, Partner at Sequoia and formerly COO & CFO at Instacart, wrote a blog about the ups and downs during a period at Instacart which highlights this point. Ravi reflects on the value of a demanding and supportive board member, Mike Moritz, and how Mike rolled up his sleeves when unexpected challenges faced the company:

“He delivered a simple and devastating message: if we didn’t change – immediately – we would go out of business…”

About 18 months later, Instacart’s largest customer was acquired by Amazon which could have presented an existential threat to the company:

“Mike pulled out his computer and wrote our press release himself…Most people think of demanding and supportive as opposite ends of a spectrum. You can either be tough or you can be nice. But the best leaders don’t choose. They are both highly demanding and highly supportive. They push you to new heights and they also have your back.”

8. Activate your C-level

As CEO of the company, all eyes are on you when push comes to shove. But, the best CEOs hire-up and bring in C-level management that can assume important responsibilities and help the company level-up. Many of these C-level execs should be exposed to the board regularly. This serves a few key purposes: (i) empowers your executives and makes them accountable toward the company’s governing body and not only to the CEO; (ii) exposes the board to what’s under the hood, feel more involved but also flag human capital issues they see which you may not; (iii) demonstrates that your company is not a one-man/woman show.

“It doesn’t make sense to hire smart people and then tell them what to do; we hire smart people so they can tell us what to do.” Steve Jobs, Apple

9. Manage personalities and ego

When you bring together experienced people from different backgrounds, personalities and egos (including your own) may clash and power struggles can emerge. Set expectations and craft specific roles and responsibilities to ensure each board member has a unique voice that does not overlap with others. Before meetings, prepare clear agendas and update members 1x1 in advance of meetings understanding that there is zero tolerance for surprises. At the meeting, allow each member to be heard but always remember as CEO, you run the meeting and should not let any member filibuster or hijack it.

10. Make clear recommendations.

One of the most challenging tasks for a CEO is managing competing interests or opinions around the table driven by different board members’ past successes/failures, personal or respective fund interests. While it is the CEO’s duty to facilitate and encourage open discussion on key company topics, beware of trying to accommodate every board member’s wish. Defaulting into a people-pleaser mode of operation generates ‘committee-like’ decision-making which tends to regress to the mean. It is your job as CEO to take in the board’s feedback, compile and assess it in the context of your own expertise and knowledge and make crystal clear recommendations for plans of action. Your recommendation will either be approved as is, refined or be the topic for discussion. Do not create a “what do you think I should do?” environment. If board members sense hesitation or confusion, they will frequently take control and force a decision on the company. It is critical to remember that you are the leader of the company and the board is there to guide and give you tools for effective decision-making. If you project indecisiveness, someone will inevitably step in and take over.

11. Deal with problematic board members.

Even if you implement some, most or all of tips 1-10, you may still find yourself in a situation with a problematic board member who is value dilutive to the company creating a lot of background noise by trying to micro-manage, interfere, opposing important strategic decisions regularly or guzzle the CEO’s time with unproductive tasks and ‘down the rabbit hole’ discussions which do not progress the interests of the company. The first course of action is to try to resolve this 1x1 by having an open discussion with clear examples of what is working and what is not and why. Lead with evidence and not emotion. You may also enlist the support of other board members who agree with your perspective and recruit them to engage with the difficult board member in an attempt to rectify the situation.

If you’ve tried everything with your investor-appointed board member (independent board members are much simpler to remove) and there is no improvement, it may be time to think about how to reshuffle the board composition. Consider initiating a conversation with the investor (fund/family office etc.) that appointed this director to seek a replacement and/or augment the board with independents to help balance the impact of this problematic member.

“Board members are not there to sit in judgment of you but rather to collaboratively problem-solve with you. If you’re not able to discuss the company’s biggest problems with them, you’re much less likely to make meaningful progress.” David Sacks, Co-founder & Partner, Craft Ventures

A lot of psychology is required to be a successful CEO and manage a strong, effective board. The tips above require CEOs to pay attention to their board on an ongoing basis, not just before the quarterly meetings. While this may seem like a very time-consuming exercise, the above will likely increase your probability of retrieving true value-add from each of your board members. As CEO of a start-up at every stage of the company, your most valuable resource is your time! With regard to the board, better to focus that time on mobilizing them to produce value for the company by genuinely fostering those relationships rather than working overtime to resolve conflicts because individuals and dynamics were neglected for too long. As the CEO, you are empowered with agency and even in the presence of difficult personas, you can drive for optimal results. View the board as your company’s force multiplier rather than a box that needs to be checked.

YOU GOT THIS!

About the author

Netalie Nadivi is a professional early-stage investor who has participated on multiple boards, advises start-ups and coaches CEOs. She has a passion for partnering with founders with hustle that are obsessed with problem solving.

Netalie can be contacted at [email protected].