Last year, we asked OpenVC users to contribute to a massive study on Euro VCs produced by an international research team. Well, the results are in!

To access the study (including a downloadable PDF), click here.

If you're a bit lazy, just read on. I highlighted some cool facts from each section of the study. Hopefully, this primer will make you want to read the full 76 pages!

Table of Contents

About this study

This study is the result of an insane amount of work produced by a research team from 8 European universities, under the leadership of Benjamin Le Pendeven, Associate Professor at Audencia Business School. Kudos to them!

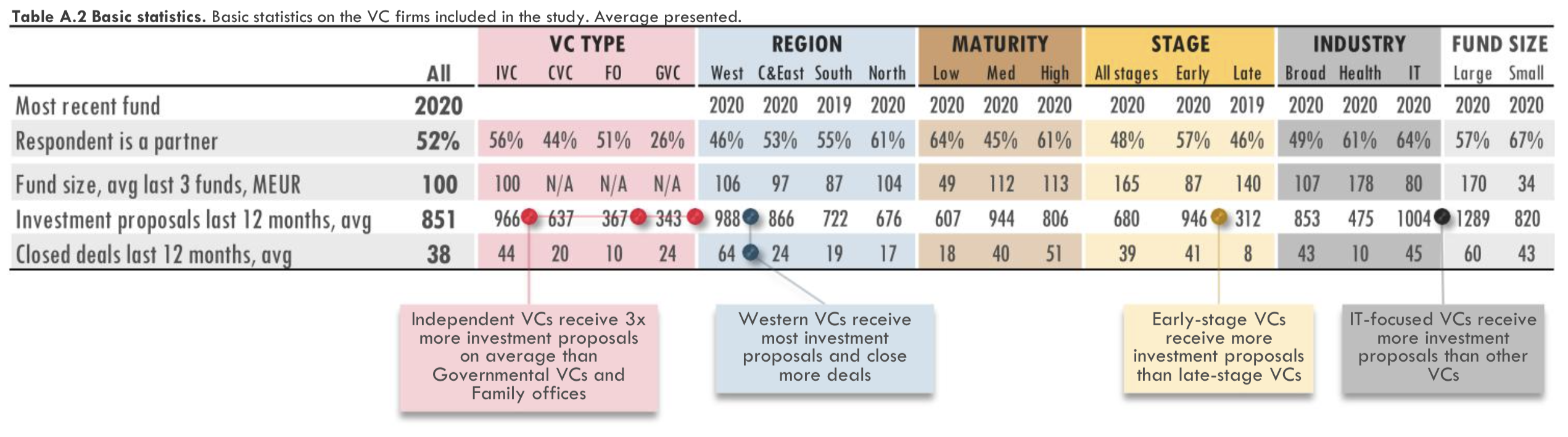

885 VCs across Europe have contributed to the data. The OpenVC community took its part by answering the survey, therefore providing quantitative data for the research.

Big thanks to everyone who contributed, you rock!

1. Pre-investment

1.1 Deal funnel process

European VCs receive 851 investment opportunities per year on average.

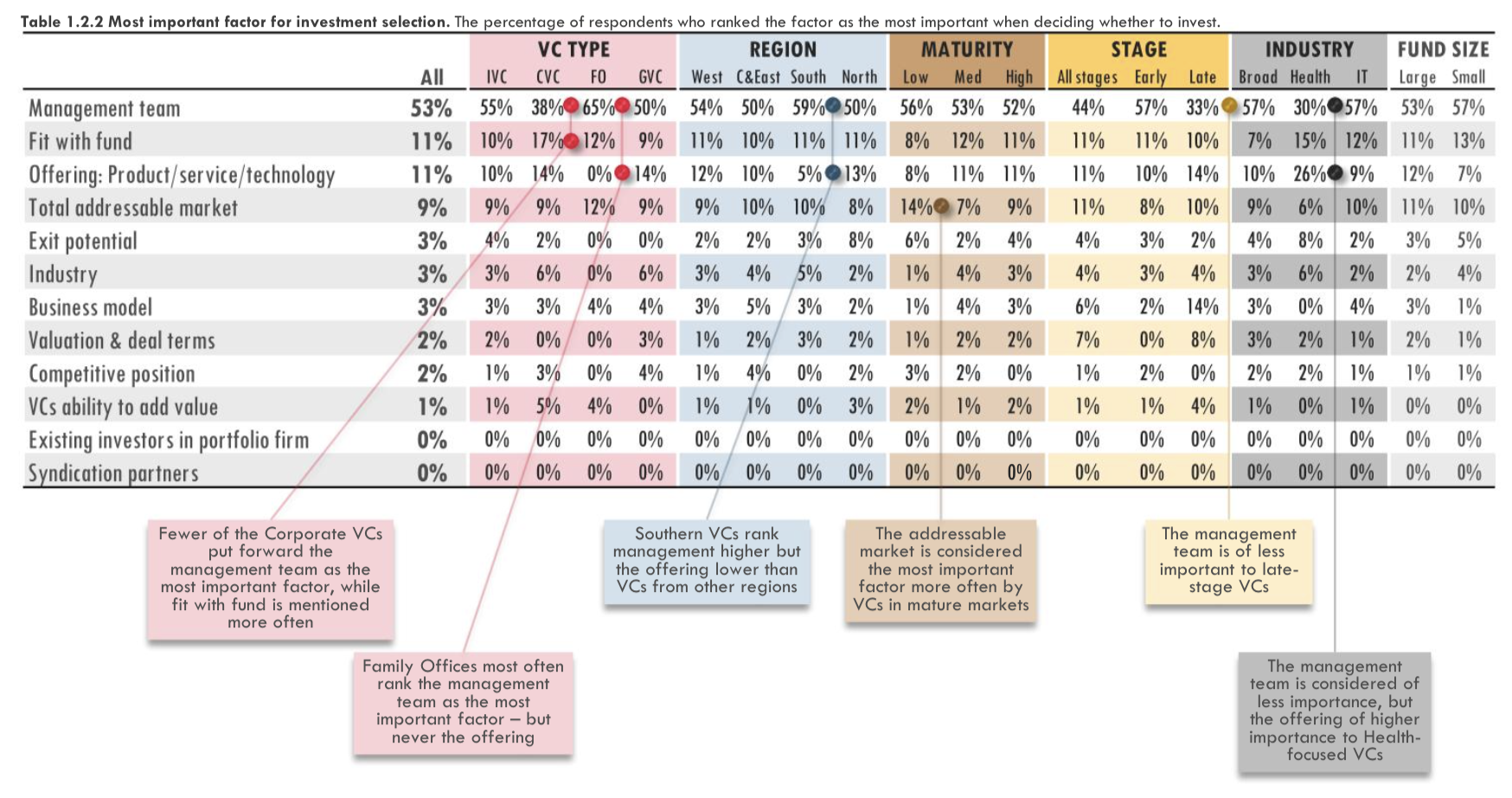

1.2 Investment selection

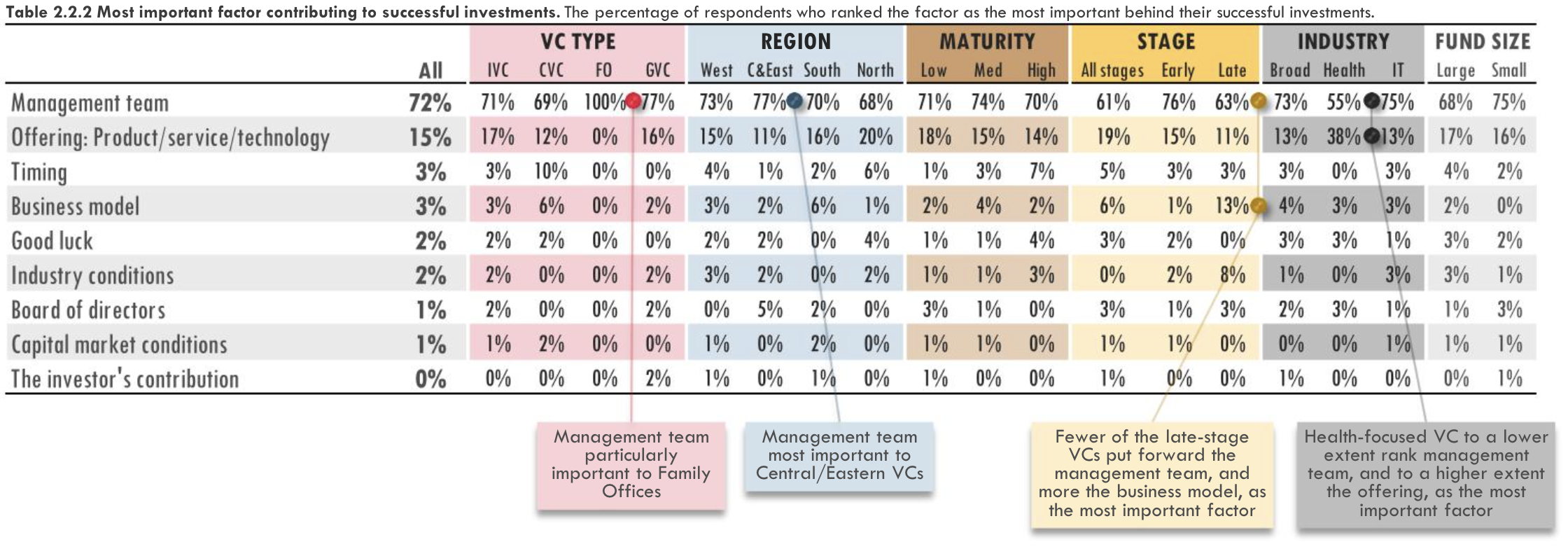

The management team is by far the most important factor when deciding to invest.

This confirms the findings from a previous study that we highlighted in our previous blog post 15 research papers every VC should know.

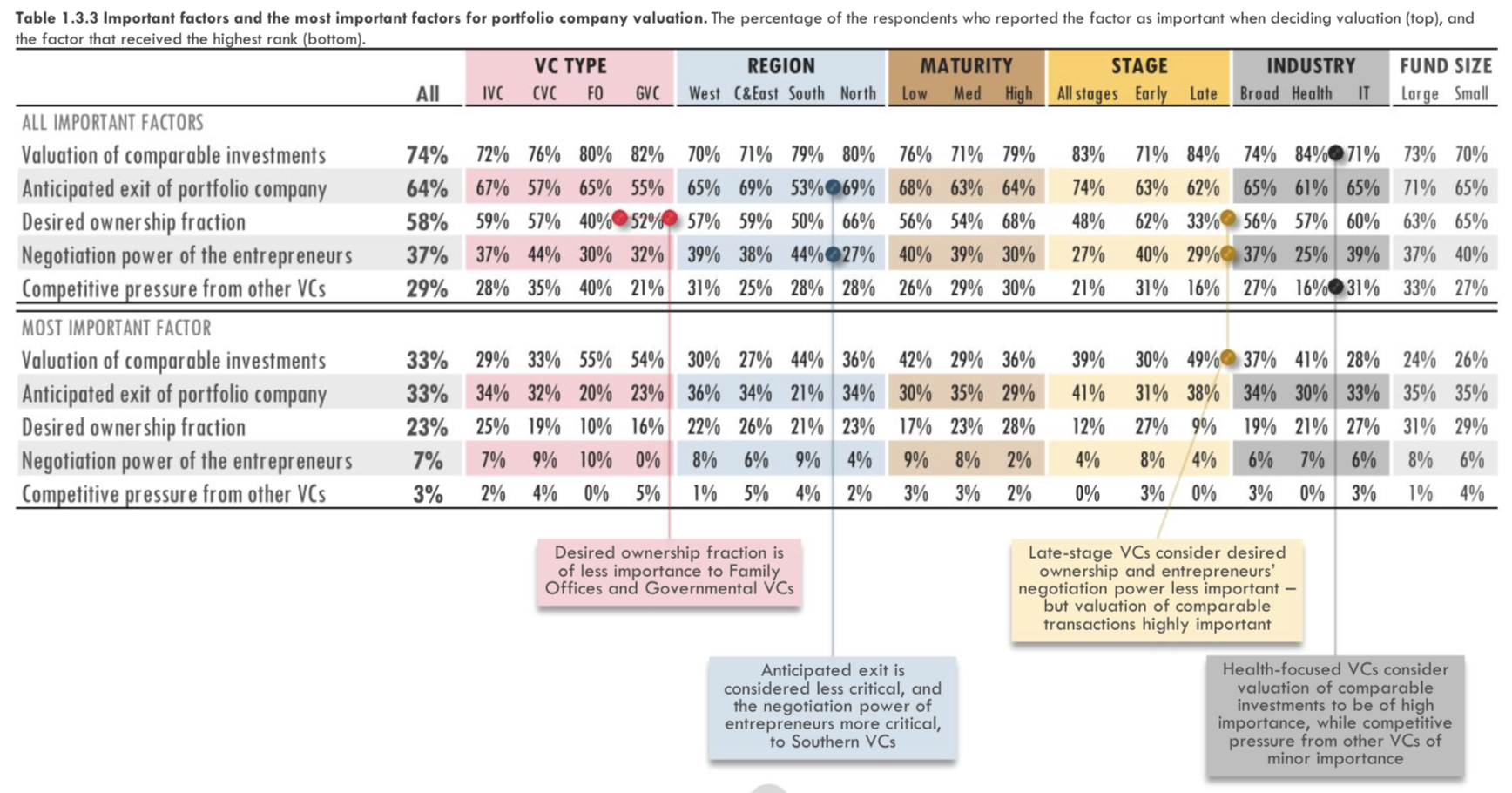

1.3 Valuation

To determine valuation, most European VCs don't use a clear-cut methodology, but combine comparables with other approaches (ownership target, anticipated exit, etc.) to get a sense of the right valuation.

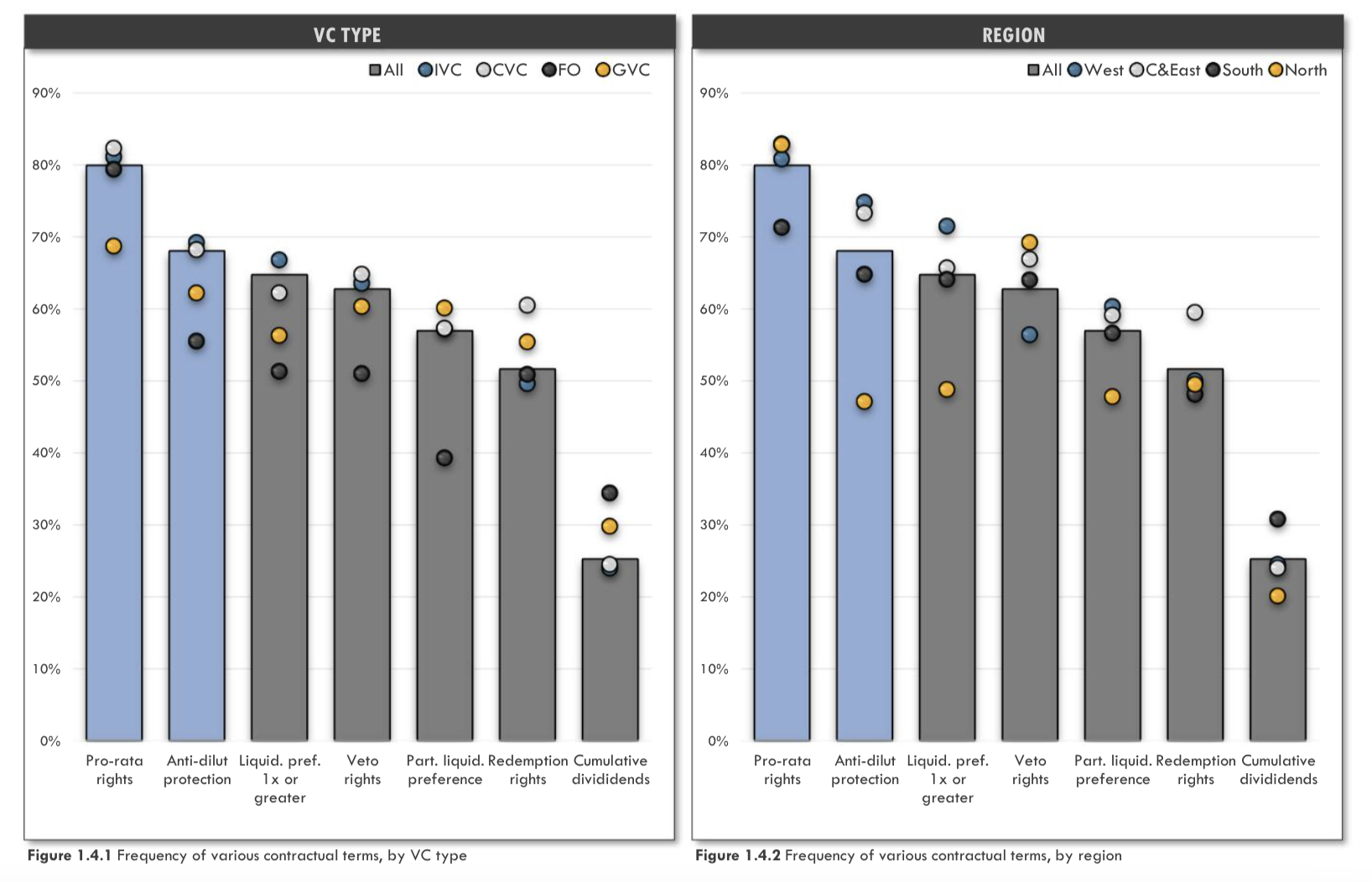

1.4 Deal structure

When it comes to deal terms, Euro VCs care about pro-rata rights the most.

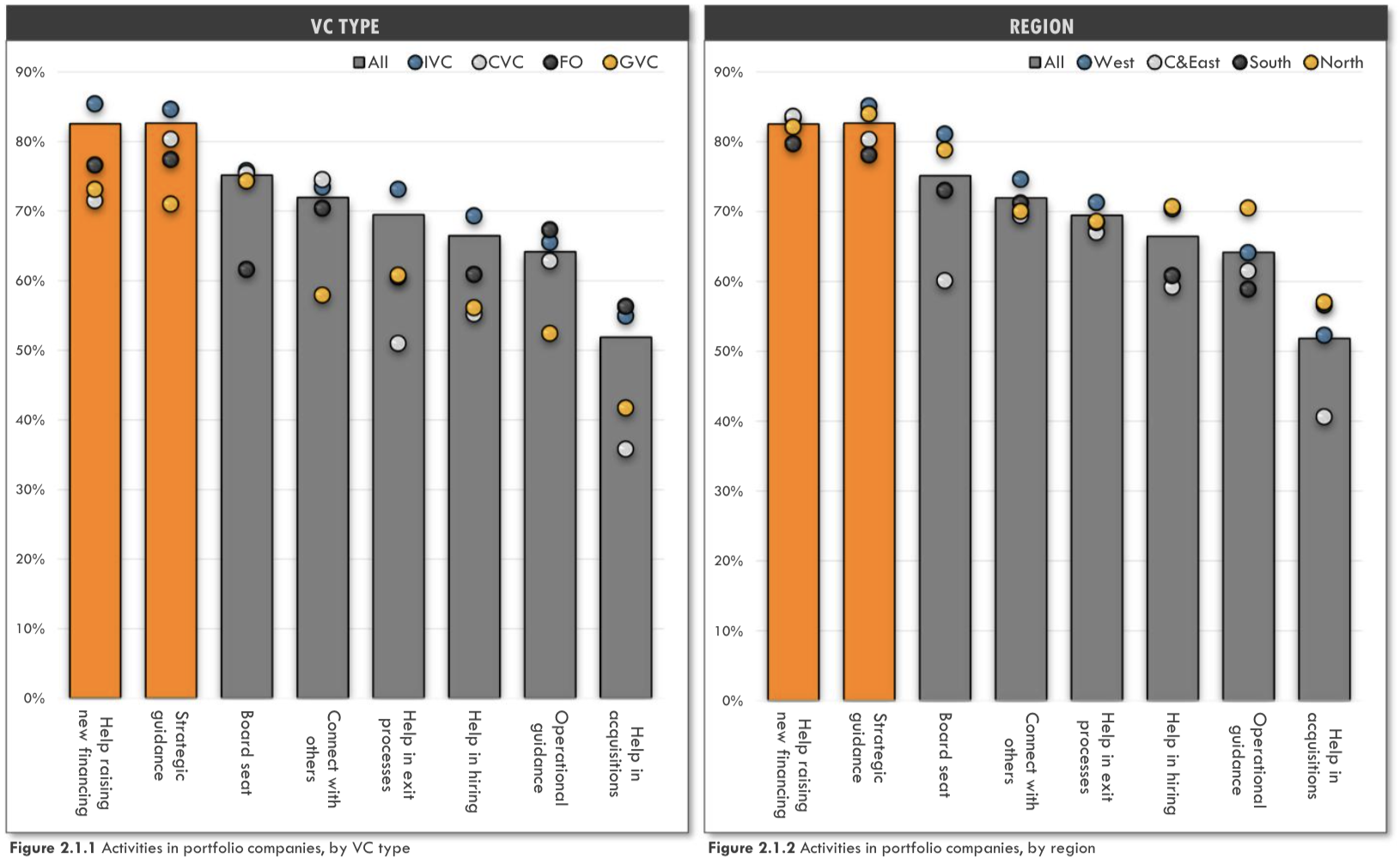

2. Investment

2.1 Value added activities

The main way Euro VCs create value is by helping their portco raise the next round and through "strategic guidance".

2.2 Successful and unsuccessful investments

When looking back at successful and unsuccessful investment, the quality of the team (or lack thereof) is considered the driving factor in both cases.

3. Post-investment

3.1 Exit routes and multiples

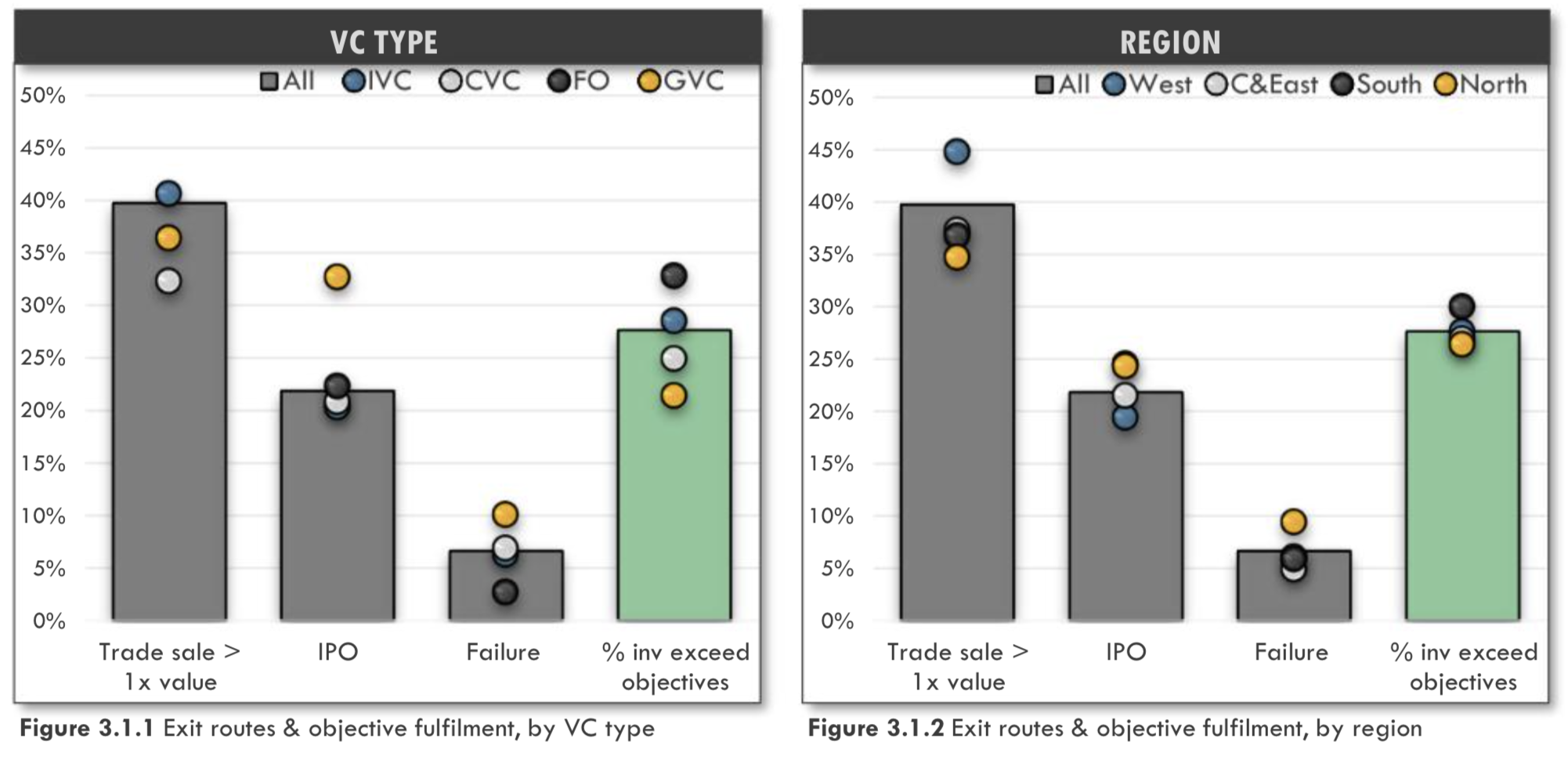

Most exits happen through acquisition rather than IPO and the multiples will shock you (read the full study for the numbers!).

3.2 Investment outcomes

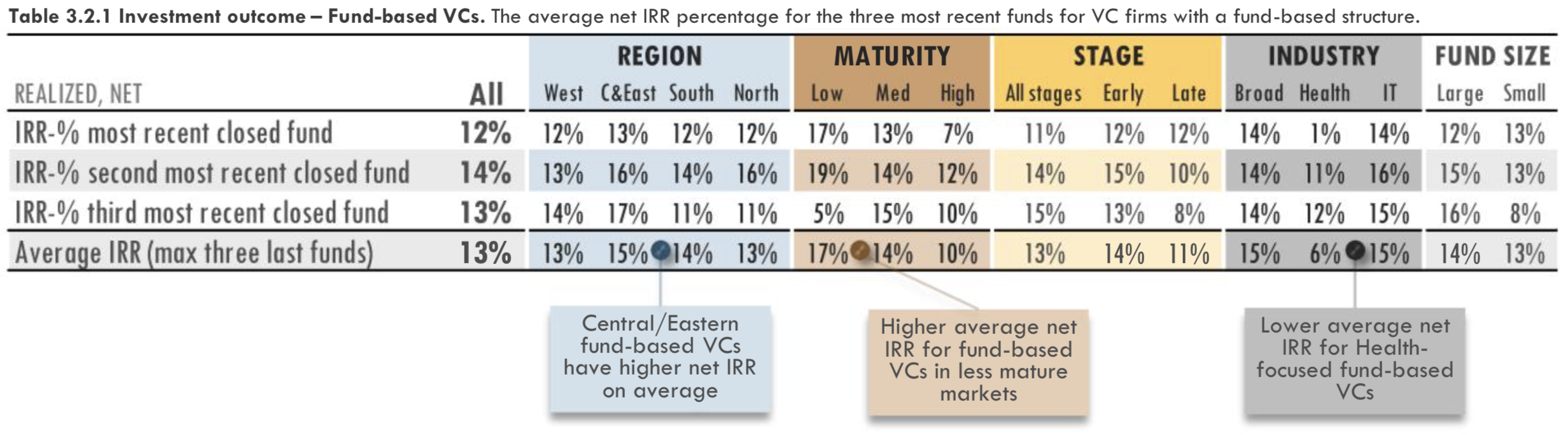

The average net IRR for Euro VCs stand at 13% with significant variations across geographies and verticals (again, read the study for all the numbers 😉 ).

4. Internal organization

4.1 Syndication

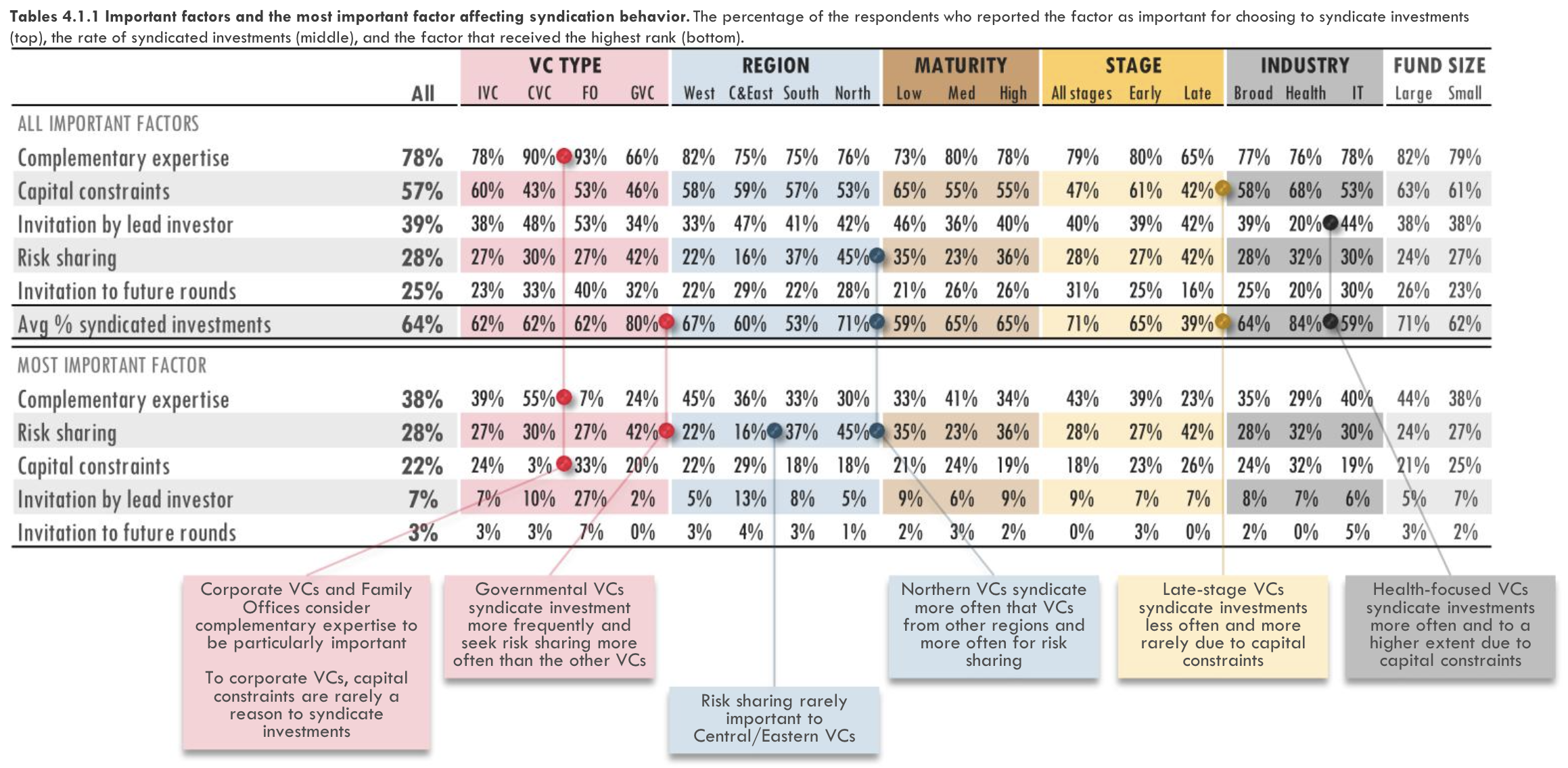

Two-thirds of Euro deals are syndicated. This is especially true for Governmental VCs, health/life science deals, and in the Nordics.

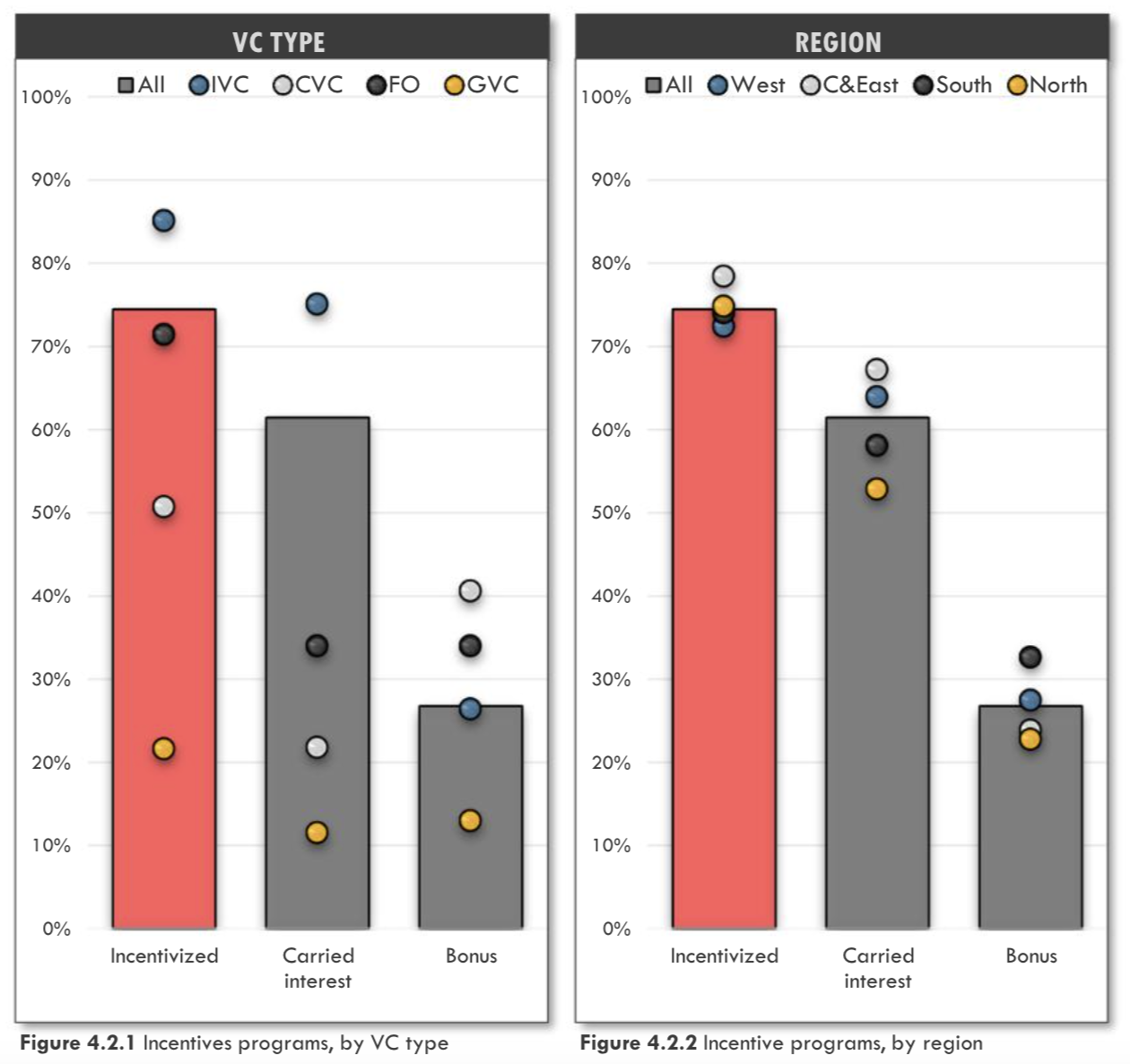

4.2 Incentive programs

74% of Euro VCs have an incentive program (scout program, bonus, etc.), which is usually carry-based.

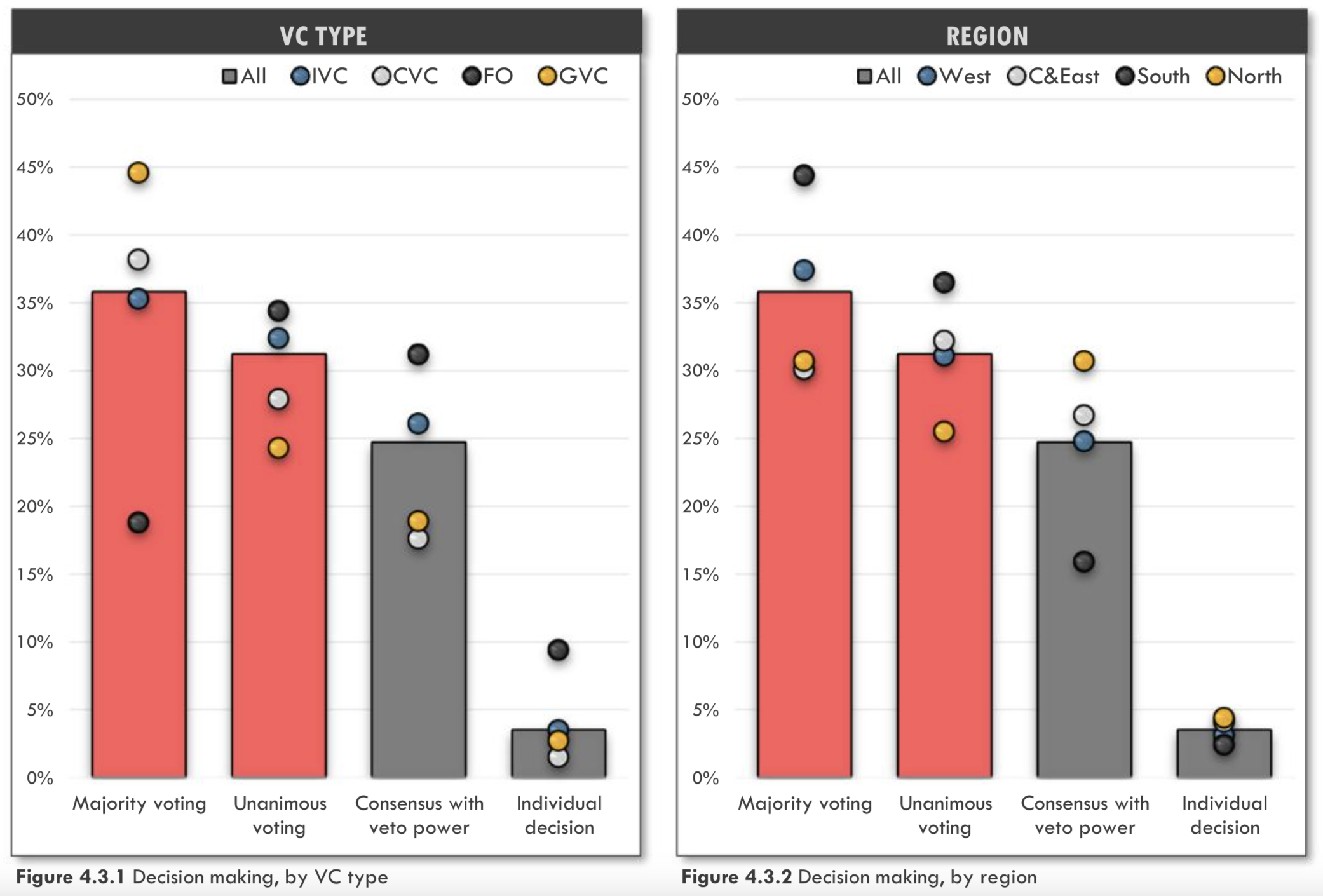

4.3 Decision making

36% of Euro VCs make decisions by majority voting, while 31% require unanimity.

So much for the contrarians!

Conclusion

I hope you enjoyed this little primer. The full study is way beefier and definitely worth your time. Check it out here.