At OpenVC, we see 10,000+ unique startups per year.

Now, you can access the top 1% before these rounds close.

Directly from the founders - no middleman.

That's OpenVC Flow.

A better sourcing experience for VCs & Angels

We designed the experience with investors in mind:

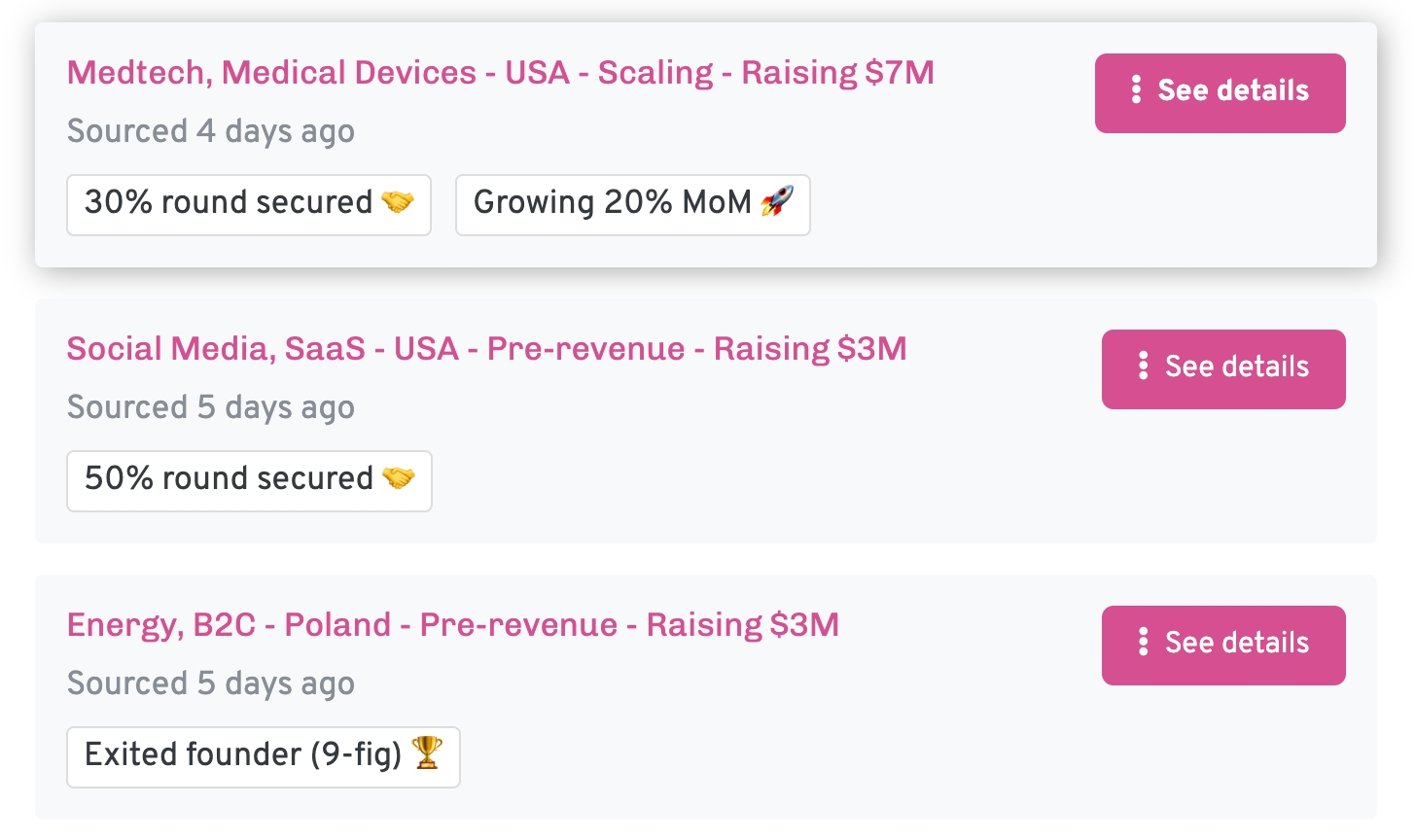

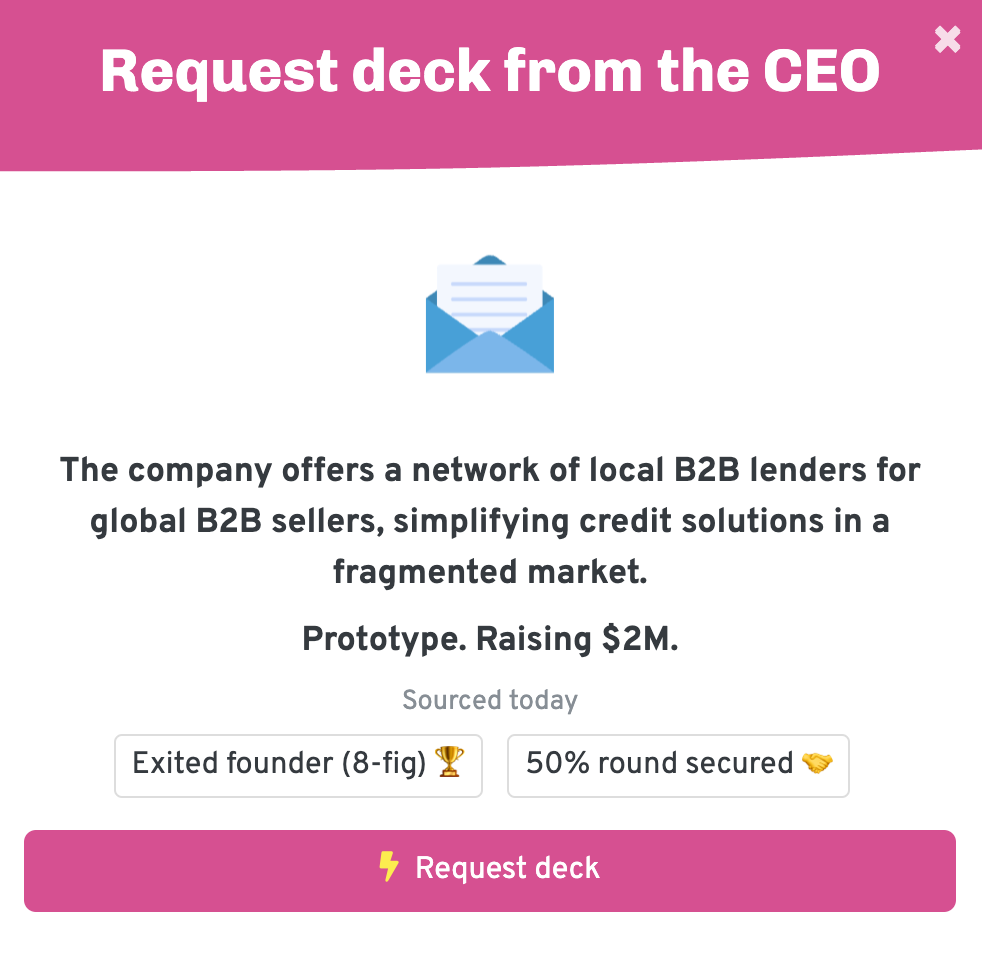

- Curated: All deals show strong signals: exited founders, hypergrowth, lead secured.

- Private: Every deal is anonymous until the founder accepts the investor request.

- Free: True to our ethos, OpenVC Flow is 100% free for both sides.

We ran the beta with 50 VCs and angels, and generated 44 qualified calls out of 203 investor requests - all self-service, with only 3 clicks from each side. So we think you will like it. 😊

Get started now with OpenVC Flow

If you're an investor, OpenVC Flow is active today.

Please make sure that your investor profile is complete and you have no pending requests before asking for new deals.

If you're a founder, follow the steps here to appear on OpenVC Flow.

Happy deal hunting with OpenVC! 😎

OpenVC Flow is just a baby step in our mission to "make VC more efficient for all".

Thank you to everyone who supported our journey so far. We have something massive coming up in October 2023 for OpenVC, so stay tuned.

Lastly, we need your voice to get better.

Any questions or suggestions, please email us [email protected].