Have you paid attention to VC secondaries?

The Venture Capital Secondary Market allows investors to sell shares of their portfolio companies before the company has had a proper exit. In another word - liquidity!

Secondaries have been steadily growing in the past 20 years and are becoming a standard tool in the VC toolbox. If you haven't paid attention, now is the time.

This massive post will provide you with in-depth insights from 4 secondary experts - compiled, prepared, and written by the one and only Derek Minno.

Let's dive in.

Table of Contents

Foreword by Derek Minno

Over the past decade, investments into the Venture Capital (VC) asset class have surged. During this period, investors from a variety of industry verticals eagerly joined the fray, hopping on the bandwagon of whatever was popular. This led to the establishment of numerous VC funds and firms. Yet it wasn’t just a rush to become a general partner (GP) of a new fund. Professionals left stable careers with established and mature companies to seize the opportunity to work with nascent technology startups that were venture-backed. Enticed by the allure of stock options, hyper-growth, and a possible big payday, everyone expected the prosperity to last for years. However, a funny thing happened along the way to the exit event.

The once endless euphoria for investing in growth companies underwent a shift when the Federal Reserve opted to raise interest rates. Suddenly, the party was over. The valuations of venture backed companies became increasingly difficult to justify. Questions arose regarding the justification of many high-priced investments. This shift altered both the VC landscape as well as the appetite for the inherent risk associated with VC investing. Instead, many opted for safer investments that promised an attractive return.

This brings us to the venture capital secondary market. This market originated in the 1980s and gained broader acceptance in the early 2000s. It experienced significant growth post financial crisis extending into the 2010s and has evolved into a recognized and maturing asset class within today’s financial markets.

Weathering a Changing VC Market

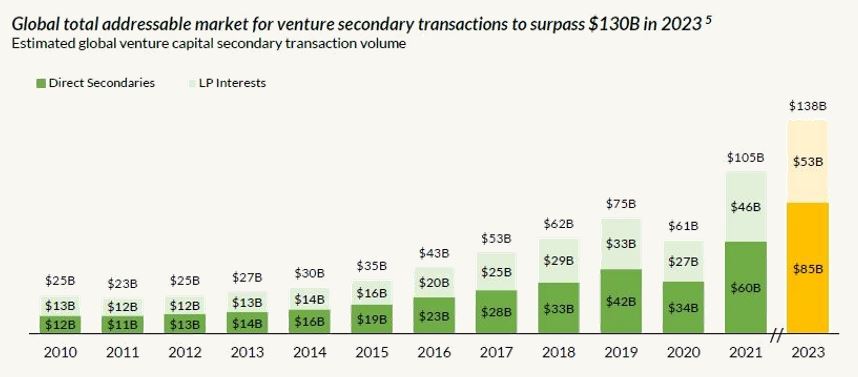

The venture capital secondary market serves a pivotal function in today’s venture ecosystem. It allows VC investors an avenue for diversification, risk management, and most importantly, liquidity. It enables investors to recalibrate their portfolios in response to evolving market dynamics and circumstances, making it an essential component of the venture capital industry. While the private equity/buyout secondary market surpasses the venture capital sector in size, there is hope that the venture capital market will expand in the future with the proliferation of research and information.

There are various transaction structures that exist in the secondary market. This includes (1) LP-led, (2) GP-led, and (3) direct transactions. To delve deeper into these methods, there are multiple informative articles available for reference. Here are a few recommended sources:

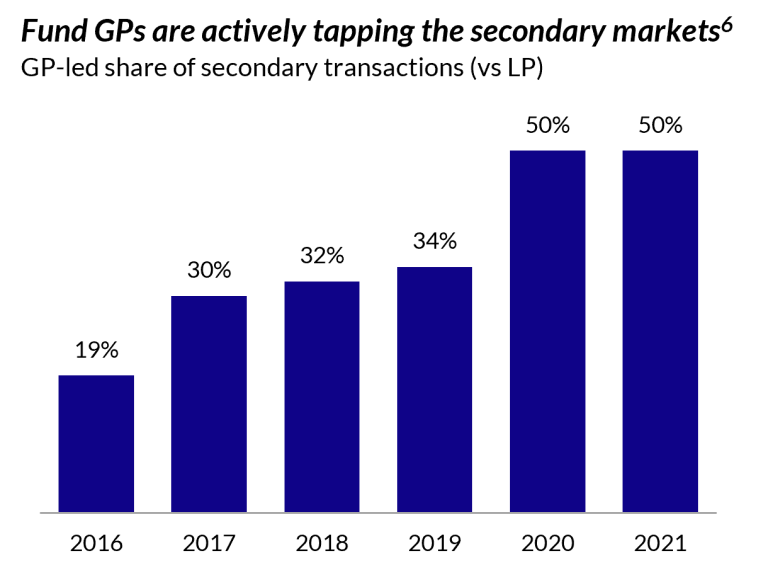

There are a variety of data collection firms that excel at generating numerical analyses, charts, and graphs. Upon reviewing this information, one can discern that there is a significant amount of value in the venture capital pipeline. However, this value does not enjoy the same liquidity solutions as other categories such as private equity (PE) and Buyout (BO) secondaries. The lack of GP-led VC secondary deals may be attributed to the unpredictability and complexity associated with venture capital. But exploring the fundamentals of venture capital can enhance the understanding of the asset value which could potentially foster increased secondary market activity.

The Magic Behind Secondaries

The goal of the content you’ll read here is twofold. First, it is to furnish a more comprehensive understanding of the secondary market via encompassing historical perspectives, best practices, market insights, and valuation analyses. Second, and more importantly, it is to foster a better-informed venture capital investment landscape for the secondary market. It is hoped that GPs and managers of VC-backed companies can navigate this market with an eye on successful outcomes.

While there are fundamentals in evaluating VC investments, there is also a touch of magic. As we explore these fundamentals, we will delve into the foundational aspects and explore some of the indicators that could be considered magical. It should also be noted that the VC landscape has a significant degree of salesmanship and pitching. The ability to sell can be a significant advantage for a VC or a CEO of a portfolio company. However, this advantage may also blind many to warning signs, causing some to run right into a wall. By engaging with these posts, you will gain an understanding that can serve as a valuable guide.

What Lies Ahead With 4 Secondary Experts

Our collection of conversations will feature insightful interviews with successful figures in the venture capital secondary market. Discussions are focused on the perspective of opportunity analysis, historical evolution, and the current as well as future market trends and activities. The participants of these interviews offer insights and contribute diverse perspectives. We will summarize the interviews and provide both key information and wisdom honed from experience.

In the first release, Derek talks with Hans Swildens, who provides a unique perspective as one of the most active participants in today’s market.

- Hans Swildens — Hans is the founder of Industry Ventures. Industry Ventures has been investing in VC secondaries for more than 20 years and Hans is considered one of the pioneers and leaders, recently raising Funds totaling $1.6B.

Future releases will feature

- Ravi Viswanathan — Ravi led the spin out of over $1 billion of venture capital assets from NEA in 2018. This was the first large VC secondary transaction and led to Ravi founding NewView Capital, which now manages more than $2B AUM.

- Ted Clark — Ted was an early member of the team at Hancock Venture Partners (now HarbourVest Partners) in the 1980s that was one of the original institutional investors in VC/PE secondaries. Ted is now a co-founder and partner at FourBridge Partners.

- Mike Bego — Mike has been an important player in the Secondary industry since the early 2000s. He founded Kline Hill Partners in 2015 to purchase secondary interests and is now one of the leaders in this industry with more than $3B AUM.

Whether you’re an Institutional Investor managing a venture capital portfolio, a General Partner at a Venture Capital firm, an employee holding stock options in a venture capital-backed company, or someone entering or exiting the industry, there is relevant and valuable information to help you maximize returns while protecting your risk. If you would like to continue to receive these interviews/white papers, have a deeper conversation on these opportunities, or participate in a future interview, contact or follow me on LinkedIn or follow me on Medium.

Derek Minno — Derek has served as a GP in a domestic VC Fund; a GP in an international PE Fund, a LP in multiple PE and VC Funds, and a C-level executive in VC backed companies. He is the President of Point Capital.

1. Hans Swildens on VC Secondaries

Hans Swildens — Hans is the founder of Industry Ventures. Industry Ventures has been investing in Venture Capital secondaries for more than 20 years and Hans is considered one of the pioneers and leaders, recently raising Funds totaling $1.6B.

1.1 Key takeaways on VC Secondaries

“Continuation Funds are attractive for GPs. They might lose a little bit on the fund being restructured with a purchase discount to NAV, but they should make it back on the continuation because their carry will get calculated on the reset value of the portfolio. It should be GP neutral and give the LPs an option to get liquidity or extend the life of their investment/partnership. Some of the LPs are going to sell, some of them are going to roll. There’s a market price because the GPs get multiple bids or offers from several buyers to determine the market price. If you ask me most of the VC funds with good investments that are old will use this structure to offer LPs liquidity and that’s how liquidity will come back to these funds vs. straight up sales.”

“Direct venture funds can’t just sell bad investments to secondary funds and then secondary funds lose money because then they’re not going to buy from them anymore. If they want the liquidity and they want the market to have liquidity, they should understand the buyer needs to make money too.”

“There’s a reason why there’s only a handful of us that have any sort of size. This type of investing is very difficult. I think VC secondary is five times more difficult than secondary buyout. And that’s why people avoid it. And you don’t understand how difficult it is, you will learn via mistakes over time on all the ways you can lose money.”

“And what’s going to happen again, is that everybody that bought over valued direct secondaries in 2021 is going to lose their money. And they probably already have lost 70–80% of their money. And we’re starting to see markdowns coming through.”

1.2 History in the VC Secondary Industry

Industry Ventures has published several white papers on venture capital secondaries. These provide a knowledgeable overview of this industry. One is focused on the Venture Capital Secondary Market and includes some of the history.

Industry Ventures — Venture Capital Secondary Market

1.3 Analysis From a Very Active Participant in VC Secondaries

Hans emphasizes that the venture capital secondary market involves complex dynamics, qualitative technology assessments, quantitative analysis, valuation differences by technology category, and a different perspective on deal structures. Despite the market’s volatility, Hans remains bullish about its growth, while emphasizing the importance of constructing resilient portfolios. In the venture capital secondary market, there are key considerations and dynamics to be aware of:

1. Due Diligence: When engaging in secondary transactions, it’s important to conduct thorough due diligence. This includes reviewing financials, cap tables, articles, preference coverage, liquidation waterfalls, revenue growth, margins, competitive dynamics, customer concentration, gross margins, and customer renewal rates. This due diligence is like what a direct investor would perform and involves both qualitative and quantitative expertise in various sectors of technology.

2. Valuation Discrepancy: Valuation can be a point of contention in secondary deals. While secondary buyers may value a company based on metrics like revenue and growth rate, sophisticated sellers might have different expectations. Sellers often consider the historical valuation they received from venture capital firms, which can lead to a disconnect between buyer and seller expectations.

3. Continuation Funds: Continuation funds are attractive to general partners (GPs). They provide an opportunity for GPs to maintain their carry interest by rolling it into the new fund. This structure can be considered GP-neutral, and LPs may have the option to sell their interests or roll them into the new fund, providing flexibility for various stakeholders.

4. Early-Stage Companies: There is a perception of high risk associated with early-stage companies that are still burning money. These companies require further funding, which resembles traditional venture capital investments. As a result, secondary buyers often focus on later-stage, more stable companies with established revenue and growth.

5. Market Outlook: Despite the challenges and fluctuations in the market, some participants remain optimistic about the growth of the venture capital secondary market. They anticipate continued expansion and scaling of their activities. However, they emphasize the need to construct portfolios that can withstand market fluctuations since many secondary investors do not always approach portfolio construction with long-term durability in mind.

1.4 Market View on VC Secondaries

The venture capital secondary market faces challenges related to valuation, understanding between buyers and sellers, and the need for profitability. It is expected to grow, but it may remain distinct from the buyout secondary market due to the unique nature of venture capital investments. Hans provides insights into the venture capital secondary market, the challenges it faces, and its prospects. Here are the main points:

1. Valuation Challenges: There are difficulties in valuing venture capital assets for secondary transactions. Unlike buyout deals, where metrics like EBITDA and cash flows are used to determine fair value, venture capital valuations can vary significantly between what was paid initially and the current worth. This discrepancy can make it challenging for sellers and buyers to agree on pricing.

2. Lack of Process: In buyout deals, there’s a structured process to determine the fair value of assets. In venture capital, there’s more subjectivity and uncertainty in valuations. This can lead to sellers expecting prices that might not make sense in the current market.

3. Understanding the Buy Side: There is a lack of understanding among sellers about how the buy side values assets. Sellers might hope to find less-sophisticated buyers willing to pay inflated prices. However, the venture secondary market is generally populated by experienced and sophisticated investors.

4. Mutual Profitability: Both the seller and buyer need to make money for the venture secondary market to thrive. Sellers must recognize that secondary funds can’t buy assets at a loss, as it would jeopardize their ability to raise new capital and continue operating.

5. Continuation Funds: Venture capital funds are increasingly creating continuation funds to handle secondary transactions. This approach allows LPs to decide whether to roll their interests into the new vehicle. This method may lead to more market volume, and LPs can assess the fairness of pricing.

6. Challenges of Venture Secondaries: The venture secondary market is challenging. There are many ways to lose money in venture capital, and a more conservative approach is needed for secondaries compared to venture capital primary investing. Only a few firms have successfully navigated these challenges.

7. Overheated Market: In 2021, direct secondaries in venture capital were trading at a premium to primary market valuations. However, this led to concerns that prices had been inflated, and investors may have overpaid. As valuations corrected, those who had bought at a premium could experience significant losses.

8. Future of Venture Secondary Market: The future of the venture secondary market is uncertain. While there’s an expectation of growth and more liquidity, it may not reach the same level as the buyout secondary market. The unique characteristics of venture capital, such as the need for high growth “rocket ship” investments, make it distinct from buyouts.

9. Cyclical Nature: The venture secondary market is cyclical and can be influenced by economic conditions. Some exchanges and brokers may survive these cycles, while others may face difficulties.

10. Desire for Awareness and Respect: Hans believes that increased awareness, understanding and institutional respect for how secondary funds operate are essential for the growth and efficiency of the market. Secondary funds are investors too, and they need returns and have a high cost of capital.

11. Sellers should recognize that secondary funds expect to make money from their investments.

12. Transaction Prospects: Despite the challenges, there are deals that can be completed in the venture secondary market. The continuation fund format is a promising approach, particularly for GPs.

2. Ravi Viswanathan on VC secondaries

Ravi Viswanathan – Ravi led the spinout of over $1 billion of venture capital assets from New Enterprise Associates (NEA) in 2018. This was the first large VC secondary transaction and led to Ravi founding NewView Capital, which now manages more than $2B AUM.

2.1 Key takeaways on VC Secondaries

“These days pretty much every cap table on the planet has folks that need liquidity.”

“We recently put together a thought piece where we discussed what we call the fallacy of discounts. We said, the focus on discounts really emerged from the private equity where you have a more efficient market with a tighter range of outcomes and multiples (generally calculated off EBITDA). So, with company X to company Y to company Z, that discount was comparing apples to apples to apples but with venture capital the apples can be vastly different. You have different financing histories, different types of companies, growth rates, burn rates.”

“We don't take binary risk. If it's real binary risk, we'd just stay away.”

“We are big believers in the venture capital secondary market. By our estimation, we think it's a $50-100B opportunity. The practitioners of secondary have been more the PE folks. And some of those PE folks have an allocation to venture.”

“I think the TVPI - DPI spread didn't have attention for a while. The tension now is this extreme need for DPI. And that is forcing that spread to close because GPs are realizing this isn't what I wanted to get, but I need to do something. I think the LPs are in every meeting saying, hey, have you sold anything? Hey, give me a check.“

“I think it'll be later stage companies that are good secondary targets. They can still be unprofitable provided they are growing and have a defined path to profitability.”

2.2 History in the VC Secondary Industry

The spinout from NEA created a $1.35 billion fund in 2018. The bulk of the funding was for the transferred NEA portfolio, including existing investments and anticipated follow-ons for those companies. There was also capital for new deals, which Ravi had done his whole career. In 2020, NewView bifurcated their strategy into two dedicated pools. NewView’s Flagship Funds are for direct investing into companies, mid -to -later stage, but secondary is a big piece of it. Then also Special Opportunity Funds, especially for portfolio acquisitions, that are dedicated to venture secondaries.

2.3 Analysis of VC Secondaries

In summary, Ravi/NewView's approach to venture capital secondaries is centered around careful selection, customized deal structures, and a focus on operational engagement to enhance the growth and value of the companies in their portfolio. Their ability to manage financing risk and efficiently allocate capital positions them as a strategic player in the secondary market. In the world of venture capital secondaries, there are several strategies and approaches. NewView focuses on these key principles and considerations:

- Financing Risk and Portfolio Selection: The level of financing risk in a portfolio depends on how you define financing risk. NewView's approach is to focus on companies that are growing efficiently, shunning capital-intensive growth. When acquiring portfolios like the NEA portfolio, they assess each company individually. They aim to allocate follow-on dollars to late-stage companies that require less capital, have secure funding, or are already fully financed.

- Deal Structures: NewView employs several deal structures based on the needs of sellers. They don't engage in LP stake sales and often refer them to their partners. The focus of their portfolio acquisition strategy is on heavy curation and typical sellers in these transactions can include seed funds, early-stage funds, later-stage funds, and older funds that are in harvest mode and are approaching the end of their life cycles. They also have the operational capacity to take on board seats, which is different from traditional secondary investors, as they can actively participate in the management and growth of the companies.

- Portfolio Preference: NewView often prefers highly curated opportunities even if the process leads to the purchase of a single company or a smaller portfolio over a large portfolio of many companies. They prioritize cash-on-cash returns and can work with a variety of stakeholders who need liquidity, whether they are institutions, GPs, angels, or individuals.

- Valuation Considerations: NewView emphasizes the importance of accurate valuations based on a company’s fundamental value. They are cautious about steep discounts that may be calculated based on a significantly inflated valuation, especially in the venture capital sector. In their view, a discounted price should be the output of a view on intrinsic value rather than an input driving decision. They often avoid deals with excessive discounts (e.g., 80%) because they believe such discounts are not sustainable as these highly valued companies are likely to raise down rounds with associated risks that may be introduced through structure.

- Thematic Focus: NewView's investment focus is highly thematic, with the vast majority of their investments dedicated to enterprise software and fintech. Their in-depth industry knowledge enables them to make informed investment decisions and tailor their investment approach and operational impact to each company's unique situation.

- Reserve Allocation: In primary investments, they reserve approximately 20-40 cents for every 60-80 cents of the original investment. This allocation is calculated based on the company's financing needs going forward. For secondary investments, the reserve amount may be lower given these companies typically are later stage and many are fully financed.

- Risk Mitigation: NewView avoids binary risks and focuses on post product market fit companies with substantial recurring annual revenue (ARR) and growth. They believe in the value of active portfolio management, risk-adjusted returns, are diligent in their underwriting process, and are disciplined when it comes to valuations.

2.4 Market View on VC Secondaries

Ravi provides an overview of the venture capital secondary market, its opportunities, challenges, and the evolving dynamics of venture capital investing. Ravi provides insights into the venture capital secondary market and the dynamics of investing in venture capital secondaries. Here are the main points:

- Market Opportunity: The venture capital secondary market represents a significant opportunity, estimated to be between $50-100 billion. This market has traditionally been more associated with Private Equity (PE) investors, some of whom allocate funds to venture capital.

- Demand for DPI: There is an increasing need for distributing profits (DPI) among General Partners (GPs). GPs are under pressure to generate returns and close the gap between the bid and ask prices in the secondary market due to LPs (Limited Partners) asking for liquidity.

- Potential Growth: Ravi anticipates that in the future, larger venture portfolios, will become more actively traded. However, there may be a need for some time to settle valuation mismatches between buyers and sellers.

- Attention to Portfolio Companies: In certain cases, venture capital firms might pay more attention to their portfolio companies than a traditional secondary market investor. NewView can provide follow-on investment and help companies secure additional funding when they might not be getting much attention from the original VC investors on their cap tables.

- Reputation Considerations: NewView emphasizes the importance of maintaining a good reputation in the venture secondary market. It's advised not to engage in short-term trading but to play the long game and support portfolio companies. Engaging in secondary trades too quickly can be seen as more aligned with a trading mentality rather than a long-term investment approach.

- Evolution of the Venture Secondary Market: NewView reflects on the relatively slow growth of the venture secondary market in the past, which might be attributed to the venture capital mindset. Venture capitalists often focus on creating something new, while buyout investors are more commercially oriented.

- Changing Fundamentals: The dynamics of venture capital have been changing. Total Value to Paid-In (TVPI) ratios and the distribution to paid-in (DPI) ratios are diverging. Fund managers have been raising capital quickly, which has created a backlog of investments that need liquidity. Secondaries are recognized to provide liquidity and effectively managing portfolios.

- Investment Strategies: The venture secondary market often targets later-stage companies that might not yet be profitable. Some companies that have performed well within the earlier funds may be ideal targets for secondaries.

- Challenges of Venture Secondaries: The venture secondary business can be challenging. There is an "evangelical" aspect to it, where convincing participants to engage in secondary transactions can take time. Bid-ask spreads can sometimes be irrational, despite the understanding that such transactions are necessary.

3. Ted Clark on VC secondaries

Ted Clark was an early member of the team at Hancock Ventures (now HarbourVest), one of the original institutional investors in VC/PE secondaries in the late 1980s. Ted is now a co-founder and partner at FourBridge Partners.

3. 1 Key takeaways on VC secondaries

“If done correctly, secondaries are an incredibly low risk strategy.”

“Even though we've had a falloff in capital, the markets are adjusting, there's still a lot of capital out there. Either raised or committed. I think that the need will be there.”

“I'm not sure anybody would have predicted the growth of the secondary market. The funding opportunity for companies that delayed an IPO created a need for increase private financing and that assisted the growth for secondaries.”

Ted describes the Venture Capital Secondary business from the perspective of an Institutional Investor.

3.2 History in the VC Secondary Industry

In the late 1980s, there were a few one-off secondary transactions, but they were opportunistic and infrequent.

By the early 1990s, the market began to evolve and become more regular. Initially, sellers were often corporate or strategic investors with underperforming venture and technology programs. Deals in the early days typically involved fund commitments ranging from $2 to $10 million, and they were viewed as add-ons to the primary fund investment business.

Hancock Venture Partners (now HarbourVest) played a significant role by creating the first dedicated fund for venture capital secondaries around 1992, named Dover Street. This marked the beginning of a more organized approach to secondary investments.

The venture capital secondary market gained momentum in the early 2000s, particularly after the bursting of the internet bubble. This was driven by two main factors:

- Many individual investors, especially in venture capital, found it challenging to meet their capital calls, highlighting the risks they had taken.

- Institutional investors, including Harvard Management, turned to the secondary market to rebalance their portfolios due to the denominator effect and imbalances between venture, buyout, and growth investments.

In the 2000s, the secondary market transformed into a fund management tool that allowed investors to manage their fund relationships, exposures, and skip the J-curve. Firms like HarbourVest recognized the potential of the secondary market as a business, leading to the creation of multi-billion-dollar funds. This shift also saw a greater focus on internal rate of return (IRR) as a key performance indicator and innovative deal structuring.

As venture capital fundraising took off in the 1990s, and approximately 5% of limited partner (LP) commitments began to change hands, secondary capital fundraising also saw significant growth in the 2000s. This expansion was not limited to venture capital but also extended to buyout and private equity markets, making it clear that the secondary market was becoming a substantial and vital component of the investment landscape.

3.3 Analysis of VC secondaries

Venture capital secondaries can be a low-risk strategy when executed correctly. This is primarily due to the diversification of portfolios. For instance, programs like Dover (HarbourVest) have hundreds of partnerships and possibly thousands of companies in their portfolios. Diversification allows for risk mitigation.

Key points about why venture capital secondaries can be low risk:

- Diversification: Large venture capital portfolios can include hundreds or thousands of companies. This diversification helps spread risk.

- Portfolio Knowledge: Investors in these portfolios often have in-depth knowledge of the companies they are already invested in. This familiarity allows for better risk management.

- Moderate Leverage: Investors may use moderate leverage to enhance returns while maintaining a risk-appropriate profile.

- Efficient Pricing: Structuring deals with efficient pricing benefits both sellers and buyers, allowing sellers to obtain a good price while buyers can participate in the upside.

- Performance: Typical performance metrics for these assets include a return of 1.5X and an internal rate of return (IRR) ranging from 10% to 20%, depending on timing.

In contrast, buyout portfolios are generally smaller, often consisting of 10 to 20 companies. While they may be easier to evaluate, this can introduce complexity, particularly in terms of deal structuring, especially from the standpoint of leverage and dealing with sellers.

3.4 Market view on VC secondaries

Ted discusses the competitive landscape in the venture capital market, changing return expectations, the growth of the secondary market, and potential concerns regarding SPVs and co-investing, as well as the influence of fund size on performance.

- Capital Availability: Despite a recent decline in capital, there is still a substantial amount of capital available, either raised or committed, within the market. This capital is being sought after by various large funds, which are aiming to raise significant amounts, typically $10-12 billion.

- Increased Competition: The venture capital market has become more competitive than ever. Large funds are actively raising capital and seeking opportunities. This competitiveness is partially driven by the need for investors who have committed substantial amounts and need to rebalance their portfolios.

- Changing Return Expectations: It is anticipated that return targets in the venture capital market will come down in the future. Instead of the previous goal of achieving 1.5 times the initial investment, the new target might be 1.3 or 1.4 times the investment. However, with managed liquidity and access to lines of credit, these investments could potentially target a 10-12% internal rate of return (IRR), seeking to provide a premium compared to public markets.

- Growth of the Secondary Market: The secondary market for venture capital has seen significant growth. This growth has been fueled by the opportunity for companies that have delayed initial public offerings (IPOs) to secure additional private financing.

- Concerns About SPV or Co-Investing from LPs: There is a looming concern related to special purpose vehicles (SPVs) or co-investing by limited partners (LPs). This could be a disaster waiting to happen.

- Impact of Fund Size: The size of venture capital funds has grown significantly over the last decade. Many firms have raised billions of dollars of capital and expanded into multi-product, multi-platform, and multi-stage investments. The increased fund size can impact performance and larger venture firms might face challenges related to their performance and returns.

4. Mike Bego on VC secondaries

Michael Bego has been an important player in the Secondary industry since 2005. He founded Kline Hill Partners in 2015 to provide liquidity to the underserved niche of the secondary market focusing on transactions smaller than other institutional firms would pursue. Now Kline Hill is one of the leaders in this industry having completed over 500 transactions and with more than $3.5B in AUM.

While the majority of Kline Hill investing is focused on the buyout space, they have extensive and successful experience investing in venture and growth assets. This article will focus on some insights and trends based on Mike’s nearly 20 years of venture secondaries experience.

4.1 Key takeaways on VC secondaries

“Compared to buyout, venture-focused secondary investing has had a slower capital formation period and less volume on the secondary market. Since the implosion of tech valuations starting in 2022, venture exit liquidity has weakened. But trends like these tend to go in cycles. So, I would expect discounts to shrink and material volume to resume, potentially in 2025 after tech valuation markdowns from their 2021 frothy peak are complete. It’s part of a larger long-term trend where the private equity industry has grown at a faster rate than the public equity market and secondary liquidity is increasingly tapped.”

“In today’s market, there is super light liquidity and that puts pressure on funds to more proactively generate liquidity for their LPs. Outside of traditional M&A and IPO exits, they can do that through a few of routes via the secondary market, including continuation vehicle GP-led transactions, sponsoring a tender process for limited partnership interests, taking on NAV lines, or selling portfolio company interests to secondary funds.”

“One of the biggest challenges with venture and growth secondary investing is conducting appropriate diligence for the opportunities and determining an appropriate risk-adjusted return for individual companies. Asset selection, diligence and pricing are all a primary focus at Kline Hill and the main reason we’ve grown the team to over 50.”

4.2. History in the VC Secondary Industry

Mike discusses the long history of the venture capital secondary market, with key inflection points and a gradual shift towards a more sophisticated and competitive landscape. The history of the venture capital secondary market can be summarized as follows:

- Dayton Carr is credited with being the founder of the private equity secondary industry in the early 1980s and was the first institutional investor focused on venture secondaries.

- The industry slowly matured and grew. However, even in the early and mid-2000s, there was a lack of understanding and awareness among limited partners (LPs) about the possibility of selling or transferring LP interests in venture funds. The entire secondary market was relatively small, with annual volume in the mid-single digit billions at this time. At that time, while most buying was buyout-focused, the primary buyers of secondary venture investments at scale were firms like HarbourVest, Lexington, and Partners Group. Competition in the market was limited, and many deals over $20 million were syndicated.

- While there was some focus on secondary direct investments in the late 2000s, the volume was relatively limited until Second Market and other nascent platforms started. Most deals in this era were for smaller tech companies, which were smaller in terms of revenue and profitability compared to the deals in later years.

- Many investors viewed the secondary approach to venture investing as offering better risk-adjusted returns and quicker liquidity compared to primary investments. Secondary investors entered the market between years 5 to 15 of a fund's life, allowing them to avoid the early losers and focus on companies with product-market fit and revenue.

- The great financial crisis of the late 2000s had a significant impact on the market, and awareness of secondaries increased during this time. Secondaries were an important resource for many distressed sellers and were a great investment opportunity at that time.

- In the 2010s, limited partner volume ramped up substantially. GP-led deals began to emerge in early scale in 2015 initially focused on “restructuring” older assets (including venture funds) until transitioning to more commonly trophy buyout assets at the end of the decade. The market saw a reduction in the number of syndicated LP deals as secondary funds raised substantially larger funds.

- While more of a trend for buyout assets during this era, many of the largest institutional investors drove volume growth by instituting regular, periodic portfolio reviews to identify assets to sell. This style of portfolio management allowed these LPs to sell LP interests if they discontinued relationships with managers, free capital for new relationships, manage exposures, and conduct other beneficial clean up. The volume of secondary transactions was relatively small, accounting for approximately 1% of total net asset value in the industry.

- Competition in the venture capital secondary market grew, but in the early 2010s it was not as intense as grew to be by 2021. Fewer firms of scale and capital pools were competing, and the sourcing of deals was less efficient than in later years.

- Some investors pursued secondary direct investments (acquiring positions directly into companies), but many found these investments (understandably) had a far different risk-return profile with a wider range of outcomes than LP secondaries. The LP secondary market remained a good approach to achieve attractive risk-adjusted returns.

- Today, the venture market has matured and now could reach $10-20B of LP secondary and GP-led volume in 2024 with an additional component from secondary direct sales that could more than double those figures. Traditional secondary firms, venture secondary specialists, and even VCs themselves are all active participants providing liquidity to LPs, venture-backed companies, and other sellers of venture assets.

4.3 Analysis of VC Secondaries

Kline Hill focuses on smaller transactions across its diversified platform, including when looking at venture secondary transactions..They typically focus on limited partner deals below $20 million and continuation vehicles below $300 million. The VC secondary market involves unique challenges, and the VC market differs from PE in terms of volume, information availability, GP restrictions, and valuation issues. These are niche areas that requires a significant amount of time and effort to source. To provide sellers with fair value, Kline Hill conducts thorough due diligence and analysis, even for deals smaller than $1-2 million in size. Given the challenges involved underwriting venture assets, firms like Kline Hill with deep experience and broad networks in the space have an advantage in being able to triage and underwrite a select set of the best opportunities.

VC asset turnover as a percentage of net asset value (NAV) is significantly lower than that of buyout funds. This discrepancy is attributed to several factors.

- Lack of Information: VC deals often lack much of the standard information that buyout funds provide. While buyout deals typically provide data on revenue, margins, EBITDA, and cash levels, VC transactions may lack these metrics if buyers do not have access to the GP or companies themselves. VC companies also have more variables to consider, such as new product launches and product strategies.

- Restrictive GPs: Some general partners (GPs) in the VC space tend to be more restrictive in allowing secondary funds onto their funds. This can limit competition and result in lower pricing for potential sellers, causing some to decide not to sell.

- Valuation Challenges: The ultimate value of VC assets can be very difficult to discern and often be not closely tied to today’s operating performance. New technology emergence and competition can create substantial risk. Often, sponsors have high marks for VC assets that force more conservative secondary investors (with less information and sector confidence than primary investors) to offer material discounts.

4.4 Market views on VC Secondaries

Though venture capital secondary market has experienced a slowdown in recent years, it is expected to resume its growth in the future. Continuation vehicles and strategies to proactively address liquidity issues are gaining importance. Valuation methods and approaches are also being reconsidered to better represent the true value of companies in the secondary market. Mike discusses the state of the venture capital secondary market and the factors influencing it. Here are the main points:

- Boom and Slowdown: The venture capital secondary market experienced a boom period after the financial crisis and continued to have high volumes until at least 2020. Going into 2021, Kline Hill and many other investors slowed their pace of venture secondaries given the high valuations at that time. The overall volume remained strong until the first quarter of 2022. However, there was a significant cooldown in capital formation and liquidity in the market since then that began to thaw a little toward the end of 2023.

-

Long-Term Growth: Despite the recent slowdown, Mike expects the venture capital secondary market to resume its growth, possibly in 2024 or early 2025. This growth is part of a long-term trend where the private equity industry has been growing over 10% per year and secondary activity growing a bit faster than that.

-

Liquidity Challenges & Factors for Growth: The current venture market is characterized by low liquidity. This puts pressure on funds to generate liquidity for their limited partners (LPs) by proactively managing assets rather than waiting for an exit. Three key factors that could increase liquidity in the venture capital secondary market. These are (1) adjusting valuations to more appropriate levels which Mike expects could wrap up in the fall of 2024, (2) return of an exit market of both M&A and IPOs for tech companies, and (3) an improved financing environment for successful companies that require capital (which may include the failure of many tech companies that should not have been funded at the valuations they were in the frothy 2020-2021 period).

-

Continuation Vehicles (CVs): CVs are seen as a valuable tool to address liquidity issues. They provide flexibility for LPs who desire immediate liquidity while allowing GPs to continue managing their assets with high conviction. Mike suggested that continuation vehicles could account for a significant portion of exits in the future, possibly up to 20% especially at times when other exit avenues are limited. However, adoption within the venture capital segment remains a fair bit behind buyouts.

-

Discounts on Liquidity: The discounts on liquidity differ by asset class. Infrastructure funds may have lower discounts, followed by senior private credit funds, buyout funds, and venture capital, which can have higher discounts. Many are hesitant to sell assets at significant discounts, especially in the venture capital space.

-

Waves of Investors: Various types of investors have entered the private equity space over the years, including hedge funds, mutual funds, and pre-IPO investors. However, these investors tend to exit when they realize the higher risk of the asset class. Many of these helped drive up secondary pricing into 2021 but now have departed (and many with large portfolios of assets bought too expensively)

- Diligence Challenges: Due to the fundamentally difficult nature of assessing technology companies whose outcomes could vary wildly and may be hard to predict, often restricted information, and the need for a high-level knowledge and experience in often narrow tech sectors, the venture capital secondary market faces challenges related to assessing the risk-adjusted return for individual companies. One result is that it is often safer to invest in diversified pools of high quality, well priced tech assets and only taking on concentrated exposure with great care and selectivity. Firms such as Kline Hill with deep experience investing across venture cycles and broad networks within the industry have an advantaged starting point in being able to conduct the appropriate diligence on venture opportunities.

5. Mike Boggs on VC secondaries

5.1 Key takeaways on VC Secondaries

Mike Boggs is a Managing Partner at Revelation Partners, whose specialized strategy is to provide liquidity and capital solutions to healthcare investors, companies, founders and funds. Revelation Partners manages over $1.5 billion and recently raised a $600 million Fund, making them the largest dedicated provider targeting healthcare secondaries.

“If you look at where we are today there has been $300 plus billion invested in healthcare over the last nine years. Those investors have only received back in cash ~40% of their investment to date. Also, depending on how you want to slice it, on paper the unrealized value of that investment is worth~$250 billion. There is a massive opportunity to provide liquidity to investors in these investments that have a need for cash..”

“Last year we invested over $190 million across all healthcare segments, which is 6x what we did on our first year as Revelation, so the dynamic has really changed, and the market is really exploding in terms of growth in every dimension.”

“ If you're in the biotech world 95+% of the time you are dealing with a company that is pre -commercial and will exit before it ever produces any commercial revenue. As a result, as an investor, you are primarily underwriting whether the company is a better mousetrap story or whether the company is going after a big market opportunity that nobody has figured out. When we have invested in biotech, which is about 15% of the time, we have generally tried to skew our exposure towards the first category which is we're looking for a better mousetrap. Typically these companies have proven regulatory pathways and proven reimbursement. We can also look at prior clinical trials of a company and understand why the current trial they are running is de-risked.”

“Many of the companies we evaluate need to raise money. However, they typically have one or two investors that can no longer invest and support the company. We can serve as a catalyst to help bring together financing. This helps the company solve their financing at the time we do our deal. As an example, we can price a primary round in conjunction with providing secondary liquidity thus catalyzing a financing event that de-risks the company. “

“In our world there's never a debate around the quality of a company. If you want to sell to me and I want to buy from you, we tend to not debate that XYZ company that you hold is a good company. Instead, it's what price you (the seller) want and what price I (the buyer) am willing to pay. We have found that if our discount or bid / ask spread is too steep there's never going to be a deal.”

5.2 History in the VC Secondary Industry

Mike reviews how Revelation Partners, originating out of an opportunistic transaction in 2008, now manages over $1.5 billion. The secondary market for healthcare, with over $250 billion in unrealized value, suggests further growth potential. Revelation invested $190 million last year, solidifying its role as a key liquidity provider in this expanding market.

- Origin of Revelation Partners: Mike Boggs and Scott Halsted met while buying a portfolio of investments from Boston Scientific around 2008. They partnered on several similar deals, typically raising money for the transactions in special purpose vehicles (SPV). After establishing a track record, Boggs and Halsted aimed to replicate their success with Revelation Partners.

- Unexpected Growth: Revelation Partners now manages over $1.5 billion and is investing out of a $600 million fund, a scale that seemed unlikely six years ago. With over $250 billion in unrealized value, the market for providing liquidity to private healthcare investors has room to grow. Boggs initially envisioned a niche market but was surprised by the market's expansion. This year, Revelation expects to invest over $250 million as the sole liquidity provider for this market.

- Market Evolution: The market has evolved, making it easier to execute certain types of deals. Investors have become more accepting of secondaries, unlike the earlier antagonistic dynamics. The maturity of the market has reduced the need for extensive education on secondary transactions, streamlining deal processes.

- Changing Dynamics: With the general acceptance of Continuation Vehicles (CV), the approach to deals has shifted, with a focus on creating win-win situations. Sellers can now receive earlier economics, LPs don't have to sell, and buyers get a deal that works for them, contributing to smoother transactions.

- Market Maturity: The market's overall maturity, coupled with improved deal dynamics, has facilitated a more efficient and accessible secondary market, contributing to Revelation Partners' growth and success.

5.3 Analysis of VC Secondaries

Evaluation of regulatory, reimbursement, and clinical risks is crucial. Preference for companies with proven regulatory pathways and reimbursement, focusing on de-risked trials.

- Ownership and Check Sizes: Ownership percentages typically range from 1% to 15%, with a target exposure of $15 to $25 million. Initial check sizes can vary from $500,000 to $25 million if there is a path to get to the desired exposure. The approach involves flexibility, writing smaller checks with the intention to build positions with multiple groups.

- Value Proposition: Revelation Partners provides value to investors (by identifying quality investments), counterparties (by providing liquidity), and operating companies (by providing additional financing). They act as (maybe) the lone liquidity provider in the private healthcare market, presenting a unique option for liquidity in a market where alternatives are limited.

- Pricing and Value Assessment: Only target quality companies. If too large a bid/ask spread, the deal never happens. Revelation Partners focuses on determining the price for transactions. The pricing is based on a calculated approach, considering the fundamental view on expected exit values.

- Return and Duration: Targeted gross returns comparable to growth equity and PE investors with a typical duration of less than three years. Actual outcomes often show faster exits and lower multiples than initially underwritten. Of course, not every deal works according to plan.

- Follow-on Exposure: Revelation Partners considers follow-on exposure in underwriting, often assisting in financing a company during transactions. The firm may fund a primary in conjunction with providing a secondary, catalyzing a financing event that de-risks the company.

- Success Story: Revelation Partners successfully acquired 15 healthcare equity interests from GE in a $150 million transaction. Initially skeptical of the deal structure which included IT and healthcare, Revelation Partners proposed a tailored solution to buy, manage, and invest in only GE's healthcare portfolio. The deal, completed in 2019, has been mutually beneficial, minimizing disruption for GE, transitioning the portfolio smoothly, and proving financially successful with the remaining companies performing well and exceeding the invested cost.

- Challenges: An example of a challenge is an investment in a medical device company that faced financing issues. Revelation Partners opted to step away when an anticipated financing did not materialize, showcasing the difficulties in predicting future cash flow needs.

- Business Challenges: The healthcare venture capital secondary market presents challenges due to its opaque nature. Revelation Partners operates more like a buyer in an M&A process, with only a fraction of offers resulting in completed deals.

Revelation Partners' journey reflects successes and challenges in healthcare venture capital secondaries. Their strategic, flexible, and calculated approach contributes valuable insights into the complexities of the healthcare sector, offering lessons for industry professionals in navigating this dynamic market.

2.4 Market View on VC Secondaries

Mike discusses how the secondary market is undergoing specialization evolution, mirroring multi-billion-dollar buyout firms. With over $300 billion invested into healthcare over nine years, there are liquidity needs, particularly in biotech, which remains the largest portion of invested dollars but is also the least penetrated portion of the secondary market. Revelation balances financing and secondary deal allocations. Healthcare can deliver consistent returns with medium-sized exits. Revelation collaborates with emerging managers for liquidity, often utilizing continuation funds. CVs (Continuation Vehicles) could become a significant share of investments, offering interim liquidity.

- Market Evolution: Boggs discusses the evolution of the secondary market, drawing parallels with multi-billion-dollar buyout firms diversifying into specialized sectors. He predicts increased specialization in the secondary market with dedicated teams focusing on specific sectors.

- Contrarian Approach: Boggs shares his contrarian approach, choosing healthcare pre-IPO companies post the Great Recession of 2008. Revelation Partners started with a focus on private healthcare investors during challenging times and has witnessed substantial growth since then.

- Market Dynamics: The healthcare sector has over $300 billion invested in the last nine years, with unrealized value around $250 billion. Revelation Partners primarily addresses the need for liquidity in the healthcare market, where returns often take time due to the long duration of healthcare investments.

- Sector Exposure: Revelation Partners has exposure across various healthcare sectors, with about 15% in therapeutics or biotech. Challenges in biotech include balancing cash allocation between secondary deals and supporting financing.

- Health Tech Definition: Health tech for Revelation Partners includes tech-enabled healthcare businesses, software selling to the healthcare system, and healthcare analytics, providing a broad definition.

- Generalists in Healthcare: While generalist crossover investors entered the healthcare market, Boggs notes that healthcare's consistency in regular, medium-sized exits has mitigated risks. Structural changes in healthcare, such as value-based care, contribute to an exciting investment landscape.

- Seller Dynamics: Institutional investors make up over 50% of Revelation Partners' pipeline, with a focus on emerging healthcare managers facing fundraising challenges. The firm collaborates with these managers to generate liquidity through secondary deals.

- Continuation Funds: Revelation Partners engages in continuation funds, sometimes structured as smaller deals ($100 million or less), addressing the need for liquidity, and offering a diverse portfolio mix rather than individual assets.

- Challenges in Primary Investment: Primary investors have been defensive, leading to challenges in funding for private companies. Regulatory constraints and the need for reserves have slowed down primary investors' entry into the secondary market.

- Future Trends: CVs (Continuation Vehicles) are expected to become a more significant portion of overall investments. Boggs anticipates CVs to represent at least a third of their investments, providing an interim liquidity tool for investors and constructing exposure to top-tier companies.

- Industry Change: Boggs suggests standardizing processes for specific types of deals, such as those involving individual stockholders with expiring options, to streamline and simplify transactions within the industry.