Everyone loves a good ranking.

When it comes to raising funds, you want someone who is not only going to be an investor, but an investor from a highly respected and regarded venture capital firm. Actually, research shows that getting funded by a VC with a reputable brand adds a lot of value.

So let's jump into it!

Table of Contents

Top VC firms by Reply rate to cold outreach (2024)

Let's start with a ranking that every founder actually cares about: the top VCs who reply to cold outreach. Based on our data at OpenVC, here are the 10 VC firms with the highest number of replies to cold outreach in 2024:

- Patio Ventures

- Index Exchange

- Arali Ventures

- Addendum Capital

- Lexi Ventures

- Newfund Capital

- Jerusalem Venture Partner

- Ethias Ventures

- Blast Club

- Ethos Family Office

Top VC firms by Assets Under Management (2024)

Assets under management (AUM) is the total market value of the investments that a person or entity manages on behalf of clients. High AUM is regarded as a positive indicator of quality and management experience. Here is a list of the top ten VC firms by AUM according to SWFI as of 2024.

- Andreessen Horowitz $35,849,981,940

- Sequoia Capital $28,344,680,000

- Dragoneer Investment Group $24,939,334,895

- New Enterprise Associates $17,791,690,000

- Deerfield Management $16,229,982,187

- Greenspring Associates $15,290,700,000

- Khosla Ventures $14,000,000,000

- Legend Capital $9,457,140,000

- Lightspeed Venture Partners $7,783,860,000

- Kaitai Capital $7,200,000

Top VC firms by investment-to-exit ratio (2022)

VCs don't invest out of the goodness of their hearts. They want exits. So ranking VC firms by their investment-to-exit ratio seems fitting.

Here is a list of the top ten VC firms by their investment-to-exit ratio as of August 2022 according to Clacified :

- GV Ventures. Investment to exit ratio - 23.86%

- Bessemer Venture Partners. Investment to exit ratio - 22.92%

- Insight Partners. Investment to exit ratio - 22.68%

- Index Ventures. Investment to exit ratio - 21.91%

- Sequoia Capital. Investment to exit ratio - 21.28%

- Accel. Investment to exit ratio - 19.77%

- Lightspeed Venture Partners. Investment to exit ratio - 18.79%

- General Catalyst. Investment to exit ratio - 16.82%

- Andreessen Horowitz. Investment to exit ratio - 16.71%

- GGV Capital. Investment to exit ratio - 15.14%

Top VC firms by unicorns in portfolio (2024)

A unicorn company is a privately held company that is valued at $1billion or more. That’s right. $1 billion or more. According to Crunchbase, there were 1,539 unicorn companies with an aggregated $943 billion raised and $5.1 trillion in value as of June 2024.

So who are the top VC investors who’ve backed the most unicorns?

- Tiger Global Management

- Accel

- Andreessen Horowitz

- Sequoia Capital

- Insight Partners

- Lightspeed Venture Partners

- Y Combinator

- Coatue

- Softbank Vision Fund

- Index Ventures

For an up to date list of current VCs and their unicorn investments, Crunchbase has a unicorn board that is frequently updated, complete with companies, their lead investors, total funding, and more.

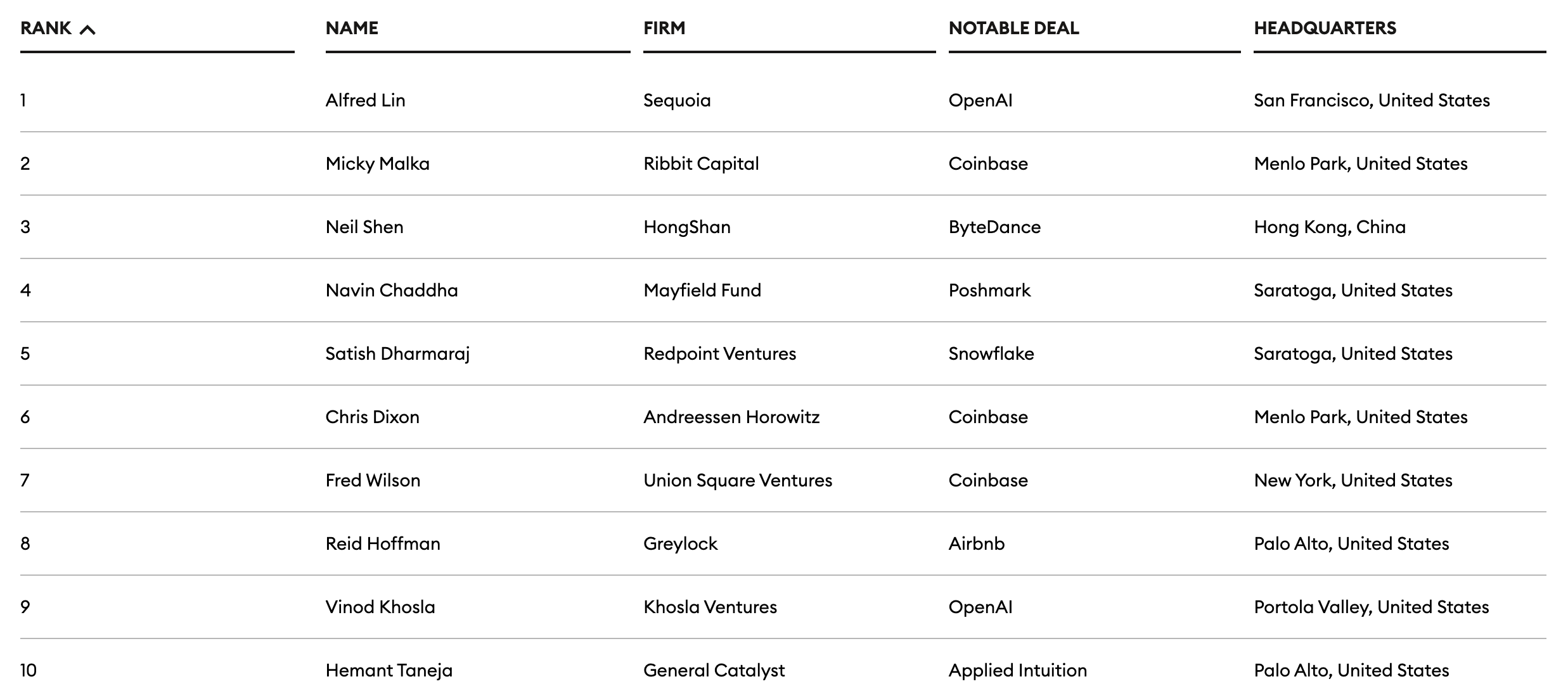

Top VC investors in the Midas List (2024)

Every year Forbes and TrueBridge Capital Partners come together to create the Midas List. This is the definitive ranking of the top 100 tech investors in the world. In order to qualify, investors are ranked by their portfolio companies that have gone public or been acquired for at least $200 million over the past five years. Alternatively, the portfolio companies have at least doubled their private valuation since initial investment to $400 million or more over the same period. Both Forbes and TrueBridge put a premium on true exits (I.E. liquid exits, show me the money) over unrealized returns. Large multiples on money invested for early-stage investors or large sums of cash returned for growth-stage specialists are also taken into account. Both play a role for top Midas List investors.

The list is data-driven and is the result of submissions of hundreds of investment partners as well as public data sources. Below are the top ten investors for 2023.

- Alfred Lin, Sequoia

- Micky Malka, Ribbit Capital

- Neil Shen, HongShan

- Navin Chaddha, Mayfield Fund

-

Satish Dharmaraj, Redpoint Ventures

- Chris Dixon, Andreessen Horowitz

- Fred Wilson, Union Square Ventures

- Reid Hoffman, Greylock

- Vinod Khosla, Khosla Ventures

- Hemant Taneja, General Catalyst

For the full list, you can click here.

Top VC firms by ELO score (2024)

Founder’s Choice uses an Elo-based algorithm (yes, like chess!) to rank VC firms, based on the founders who actually worked with these VCs. Here are their top ten as of June 2024.

- Khosla Ventures

- Union Square Ventures

- Two Sigma Ventures

- Andreessen Horowitz

- First Round Capital

- Bowery Capital

- Y Combinator

- Hoxton Ventures

- Hyde Park Venture Partners

- Tribe Capital

Top VC firms focused on female founders (2024)

As stated previously, female founders don’t get much in the way of VC investment. Here are ten VC firms who are trying to change this by making it their mission to invest in female founders according to 2024 OpenVC data :

- WIT Angels Club

- How Women Invest

- Femmes Business Angels

- BBG Ventures

- Koa Labs

- Angel Club

- FirstCheck Africa

- Go To Eleven

- Curate Capital

- Privilege Ventures

Top VC firms by followers (2024)

Twitter is a great place to keep up to date with the latest investments and startup news. Plus you learn about the early stage landscape as well as get social with them. Here is a list of the top VC firms based on Twitter follower count.

- Andreessen Horowitz. 769k followers.

- Sequoia Capital. 687k followers.

- GV. 541K followers

- Accel. 261k followers.

- Greylock. 244k followers.

- Kleiner Perkins. 236k followers.

- First Round. 218k followers.

- True Ventures. 113k followers.

- Bessemer. 102k followers.

- Union Square Ventures. 93k followers.

Feel free to follow and begin learning and even engaging with them today.

(And yes, I call it Twitter, not "X")

Top VC firms by headcount (2024)

The larger the VC firm, the larger the headcount. Here is a list of the top VC firms by employees according to their LinkedIn company pages.

- Plug and Play. 1,151.

- Accel. 1035

- Sequoia Capital. 818.

- Andreessen Horowitz 681.

- IDG Capital. 398

- First Round Capital. 359

- Kleiner Perkins. 297.

- GV. 273

- Bessemer Venture Partners. 267

- Tiger Global Management. 244

Top VC firms by US state (2021)

CBInsights has a complete list of every top VC firm broken by state. A few of the top contenders include:

- California: Andreessen Horowitz

- Nevada: Lightspeed

- Washington D.C.: NEA

The rest can be seen on the map below.

Top VC firms in Latin America (2019-2024)

Latin America is a growing market that is seeing a record breaking influx of VC. According to Pitchbook, these are the 10 most active VCs in Latin America by deal count for the period 2019 - 2024.

- Bossanova Investimentos

- Canary

- FJ Labs

- Kaszek

- DOMO.VC

- Monashees

- Latitud

- Norte Ventures

- Magma Partner

- Valor Capital

Top VC firms in Asia (2024)

Asia is a massive hub for both VC and startups. Here is a list of the top ten VC firms in Asia, courtesy of Startupstash.

- Wakermaker Partners

- East Ventures

- Sequoia Capital China

- Qiming Venture Partners

- CyberAgent Capital

- Gobi Partners

- Brand Capital

- Shenzhen Capital Group

- Zhen Fund

- JAFCO Japan

Conclusion

The fundraising journey is never easy but it helps to know which VCs to approach. Fortunately, our free and open platform has VCs broken down by industry, check size, company stage, thesis, and more. You can easily submit your deck to the VCs who are not only important in the industry, but who are personally important to you.